A short position is a trading approach where the traders or investors sell an asset while anticipating the price of the stock to drop.

Trading short provides us with a huge advantage in the financial markets since we can benefit from both the price growth and decline. In other words, it is irrelevant where the price is going to head next. When it goes up, we buy and make a profit. When it falls, we sell and still profit from it. The key here is to identify the direction correctly.

1. Short Position: How It Is Done

2. How to Short in Financial Markets

3. How to Open Short Positions

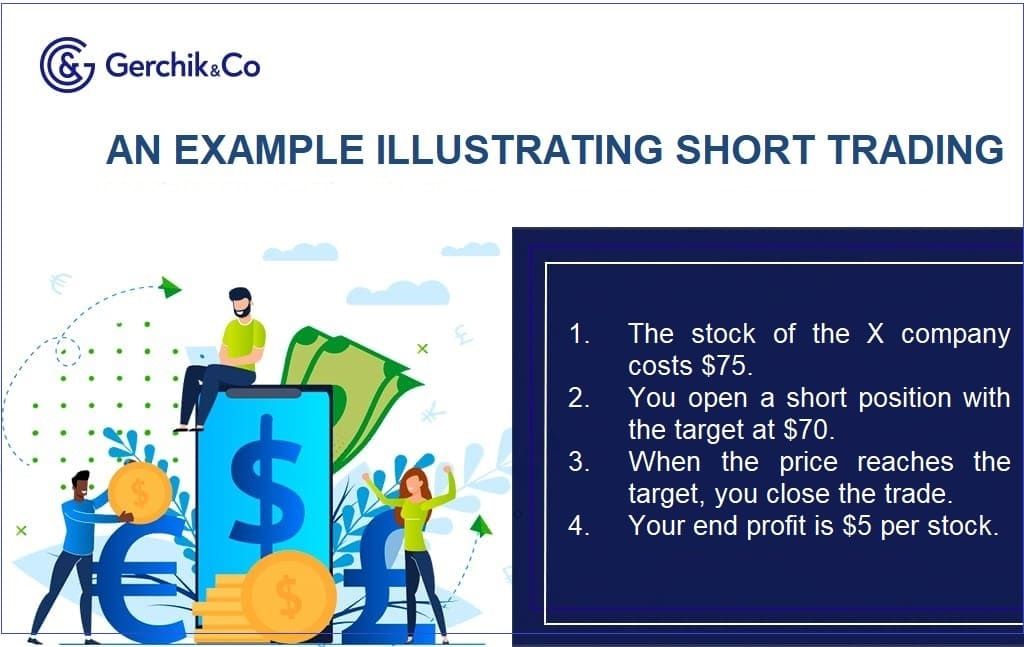

Essentially, when it comes to financial markets, you can buy a security, wait until its price goes up, sell it at a higher price and thus make a profit on the difference in prices. That seems to be clear. But what is a short position, really? It’s not just a sale of a previously acquired asset. What we do here is basically go short (which means “to sell” in trading jargon) knowing about the upcoming price drop and then when the said asset becomes cheaper, we buy it and snatch the profit.

This is not an easy thing to pull off when trading tangible goods in the market. To help you understand this mechanism better, let’s take a look at the following example.

Suppose you know that a certain product is going to become cheaper in the short run. You have a customer who is willing to pay its current price to get it. You make a deal and agree to deliver it in a week. You do not currently have the said product. However, you have an agreement for sale and money that has already been paid by the buyer. You wait for a week until the price drops, buy the product at a cheaper price, and hand it over to your customer while the amount of the price difference goes right into your pocket.

Now let’s take a look at the same process in financial markets. But first, we need to get to the bottom of what “to go short” is. As previously mentioned, it means “to sell” in the trading slang. To be even more precise, it means to sell something you don’t own in order to benefit from the price drop. This process is also referred to as a bearish operation.

Short trades in financial markets are made through margin trading mechanisms. Brokerage companies provide leverage (which is basically borrowed money from the broker) which allows traders to trade larger positions. And the margin is collateral that the owner of a financial instrument has to deposit.

Thanks to marginal trading, short trading is done as follows:

1. The trader knows that the price of the stock (e.g. Facebook stock) will drop.

2. He/she doesn’t have these stocks but wishes to profit from the price decline.

3. He/she opens a short position in a trading terminal. Basically, the trader borrows this stock from the brokerage company.

4. When the price drops, the trader closes the sell trade and takes the profit. In a nutshell, he/she buys the stock at a cheaper price.

5. The stock is returned to the broker while the trader gets the profit.

This process is called shorting.

Now you know that the short position is a way to make money on the price drop. With this in mind, you should go short when you anticipate a decline in the price.

At this stage, the trader’s task is to make an accurate forecast and determine when the price will fall. That’s when the market analysis techniques (fundamental, technical, and indicator analysis) and strategy will come in handy.

1. Fundamental analysis. Using this approach, you can evaluate the factors impacting the price. Do they support the quotes or exert pressure? How can this be identified? Learn it by completing courses and taking workshops hosted by practicing traders or read daily analytics by Gerchik & Co.

2. Technical analysis. Pinpoint the market trend, as well as support and resistance. It makes sense to open short positions in a downtrend and when the price bounces from resistance.

3. Indicator analysis. There is a wide range of indicators signaling the price drop.

4. Trading strategy. This is your trading plan based on the types of analysis described above. It includes criteria for opening short positions.

Open an account at Gerchik & Co and embark upon your trading journey now