1. Founding and Evolution Visa

2. Fundamental Analysis Visa

3. Technical Analysis Founding and Evolution Visa

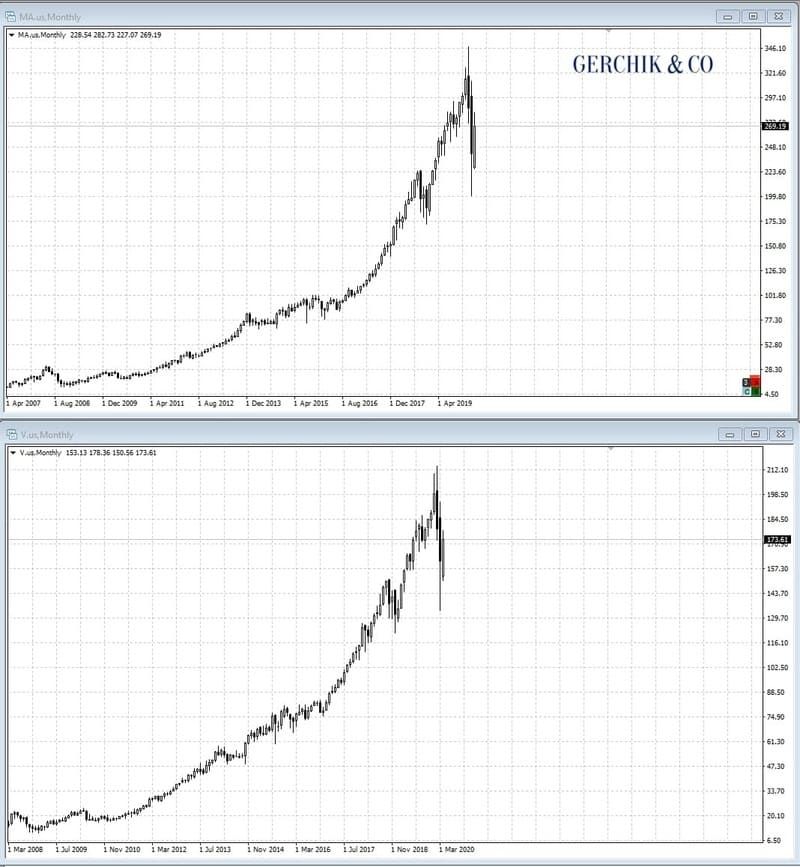

Visa or MasterCard? It is enough to take a quick glance at the charts to realize that venture investors who got their hands on the stocks of these companies made a solid profit with them.

Some of the lucky traders have possibly made the right bet. However, a rule of thumb states that traders are unable to hold on to securities for a long time, taking only cents of impulse or a couple of dollars at best. Just imagine if you had acquired these stocks at a price of 20, the account would have quadrupled in ten years. In other words, Visa or Mastercard stocks would have generated 1,000% or 100% per annum in 10 years. These are truly jaw-dropping figures!

But let’s take a realistic look at the situation. Even though I fully understand the feelings of the newbies who start calculating potential profit once they’ve opened a trade, and can picture how they will be doing their best for a quick and dramatic increase of the account balance.

The odds of picking a similar idea out of thousands or millions of startups that demonstrate a huge growth are incredibly slim. So, having chosen a seemingly promising idea, the chances of not making 100% per annum are much higher, just from the statistical standpoint. In the best-case scenario, you will keep your money in a particular price range. If the worst comes to the worst, you will quite possibly “outlive” the unsuccessful startup, having sent all your savings down the drain.

This is why, regardless of the trading approach or strategy you use, you need to factor in unforeseen negative events and mitigate them either by placing the stop loss or diversifying your assets. In terms of the blue-chip stocks also known as large-cap stocks, the risks will obviously be smaller. If the new start-up shows a certain promise, it will still have to face many challenges of the market competition, and so there are different kinds of risks here.

Initially named BankAmericard, Visa’s history began in 1958. Due to the Vietnam War, the name of the largest bank was getting many people on the east coast of the United States, in Canada, Britain, and Mexico really annoyed. So, Bank of America had to pick a different one i.e. “VISA”. The first-ever transaction was made on July 26, 1976. In October 2007, Visa Inc emerged as a separate legal entity, which is why the history of the chart dates back to this specific year.

Why can a company move away from its fair value exponentially? This is a logical question to ask yourself when evaluating the scope, credibility and prospects of the company. As far as VISA goes, 2 billion people, which is almost a third of the world's population, use the cards of this payment system, with over 6,000 transactions being made in one minute.

The difference between VISA and MasterCard lies in their profile. MA is geared up chiefly towards the European market and the Euro. Since the Visa’s primary focus is on the U.S. dollar, it is more popular.

Given the afore-mentioned, am I really interested in buying these overpriced stocks even with a certain discount? Not exactly. The company may hold its ground today and push expectations higher. However, in China, Visa and MA are currently being outcompeted by their own system - China Union Pay. So, there is a very real chance that new players will capture a significant market share. It is worth noting that these are the cash flows that are better left for domestic companies. I believe there will be a lot of those who will wish to follow in China's footsteps, and we will witness the emergence of many similar companies.

Naturally, given the already captured market share, the current monopolists have something to offer by getting rid of less financially sound competitors. That said, a fair price is a more conservative approach which, however, takes a certain degree of investor’s discipline.

Visa's capitalization totals $386 billion. The dividend yield of 0.69 is even lower than the market one.

PROFIT MARGIN FIGURES ARE, HOWEVER, QUITE IMPRESSIVE:

The number of employees is 19,500. During the time period from 2015 to 2019, the revenue increased from $13.88 to $22.98 billion. Net profit for the same time period doubled from $6.31 billion to $11.65 billion. EPS for 2019 was 5.13. At the current price of 32.45, P/E is quite overpriced, given the potential emergence of new competitors, like it happens now with Chine.

Based on the latest quarterly reports, the price was at about $1.40 per share. I do not really think that the situation with coronavirus will somehow change the upcoming April report. People continue using payment systems while quarantined at home. At 1.40, we can expect annual EPS to be around 5.6. In other words, the P/E pattern does not change all that much. However, given the low dividend yield, the risks still exceed the potential yield.

Now, let's take a look at the reports of MasterCard (MA), Visa’s greatest competitor. The company's capitalization is $269 billion, with the dividend yield being also as low as 0.59%.

MARGIN PROFIT FIGURES ARE LOOKING FANTASTIC:

The number of people employed is 18,600. By the way, it is worth mentioning that Visa is overbought, with its institutional ownership being at 97.10. In contrast, MasterCard institutional ownership is held at 78.10%. Revenue increased from $9.67 billion in 2015 to $16.88 billion in 2019. Net profit went up from $3.81 to $8.12 billion, which is one-third less than VISA. However, the dynamics of net profit doubling for the same period is similar.

EPS for 2019 was 7.94. In 2018, it was at the level of Visa’s EPS. In other words, P/E over the past year is 33.87, which is also looking pretty optimistic. Based on the latest quarterly reports, we can expect it to be at 1.80, which will be 7.2 i.e. at the level of 2019.

Based on the fundamental analysis, we can conclude that both companies are currently clearly overestimated. In terms of weight in S&P 500 (1.21%), it will also have every chance to continue going up as the Federal Reserve System is flooding the world with cheap money.

What problems may the company face? This can be the intensifying competition with China, the emerging new market players, and the risks of accelerating inflation. All of this may eventually result in a debt crisis again.

First things first, let’s take a look at MasterCard. Coronavirus hindered an update of heights which were already approaching 350. Naturally, all kinds of market scenarios are possible. For example, following many years of billion-dollar losses, TSLA soared from 200 to almost 1,000 on one report alone and promises. Not without the help of short squeezes.

In this sense, half of the world’s users are covered by MasterCard and Visa.

It is obviously hard to believe that we will see a fair price in the area of 120 or at least 150. For this to happen, there has to be a severe crisis so that margin calls force us to get rid of such giants as well. However, the risks and potential are the key factors here. I personally believe that trying to catch up with the train that had already left is not such a good idea. Besides, there are plenty of other companies on the market to choose from. Currently, from a technical standpoint, the price has returned and is trying to consolidate above 258.

Back in 2018, Visa was relatively close to fair value, closer to 100; however, level 129 stopped the correction. Upon a false breakout, there was an almost recoilless growth until July 2019, which was followed by consolidation at 167.50 where another impressive impulse originated from.

Against the backdrop of the pandemic, the correction led to 129, but the retest did not happen. A curious situation was observed with the mirror price of 168 as there was an attempt of going short and the breakout. Currently, the buyers are trying to bring the situation under control. In the case of an overvalued company, the index serves as the key factor. If it goes further upward, Visa will continue getting closer to its highs. In contrast, should there be problems with the index, the company’s stocks may plummet even further.

As in the case with such overvalued companies, the smartest approach would be to either trade the SPX500 or SPY itself, avoiding sectoral risks, stock risks with possible news or quarterly gaps, or trade speculatively beyond the foundation of a stop-loss order. Make sure not to forget about the risks of gaps and keep a close watch on the quarterly reports.

However, for venture investors, promising stocks should imply not just the likelihood of market growth but significant potential due to their undervaluation, an interesting idea behind a startup or capture of the new markets. It should be a solid idea, not just a high-profile company from the S&P 500 list.

Аutor: Viktor Makeeu