1. Story Behind Verizon Communications

2. Fundamental Analysis of Verizon Communications

3. Technical Analysis of Verizon Communications

Following my AT&T review, today, we are going to talk about Verizon Communications. This is another company formed after the breakup of Bell System in 1984. In the telecommunications sector, over 2/3 of the profits are accounted for by the subsidiary of Verizon Wireless, the largest U.S. wireless provider headquartered in Manhattan, New York, but registered in Delaware.

Judging by the acquisitions, it’s safe to say that the company has pretty solid cash flows and a decent financial safety net. In 2000, a joint venture was formed with the British, and in 2014 Verizon got its hands on it too. In June 2015, the company purchased the well-known American media conglomerate AOL. In 2016, Verizon acquired Yahoo! for $4.48 billion. This company with 1 billion active users is probably known to everyone.

The largest investors:

These are the companies that offer a wide selection of ETFs in the stock market.

The company deals with both wireless and wired communications. Aside from that, Verizon owns a large business for the phone book production and the sale of mobile phones, modems and other equipment. You don't have to be a genius to guess that Sprint Corporation T-Mobile USA and our well-known AT&T are its biggest competitors.

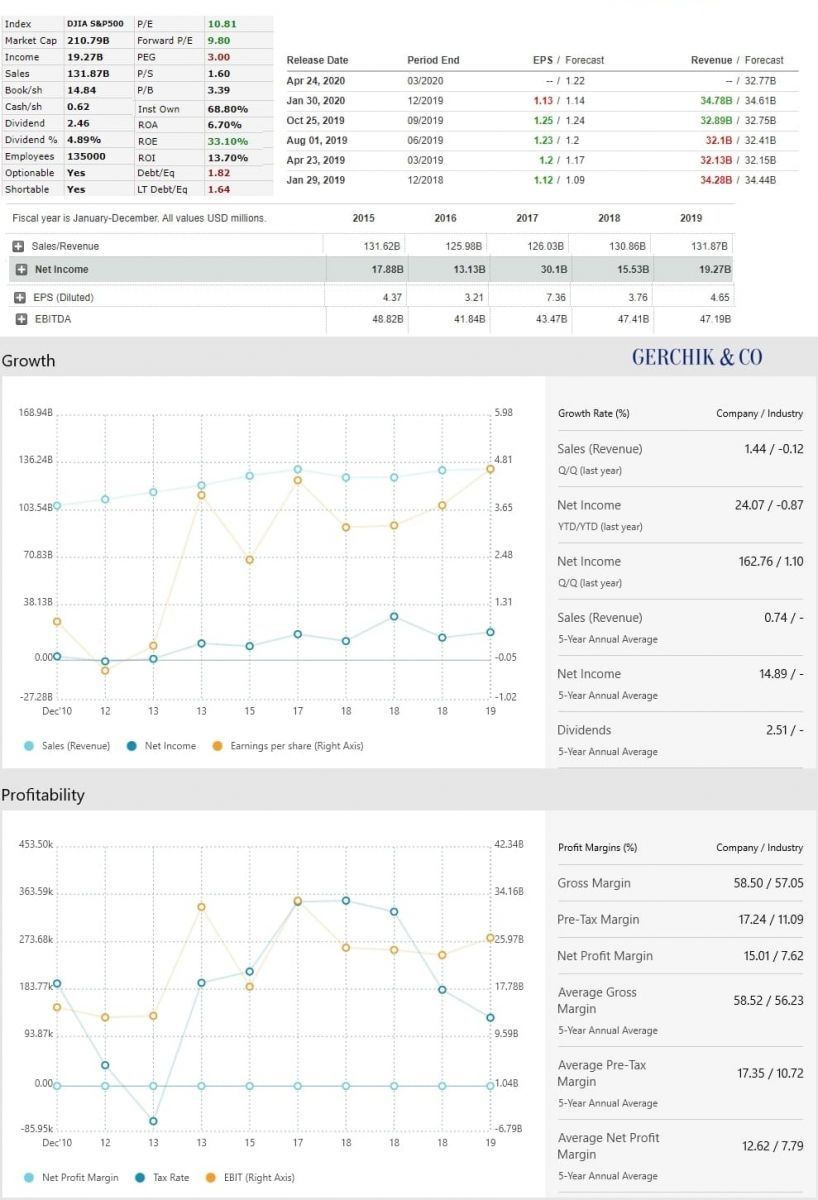

The company's capitalization is $210 billion, with the number of employees being 135,000. A dividend per share is $2.46 which at the current price is considerable 4.89%. As compared to AT&T, Verizon has pretty solid profit margins.

VERIZON’S IMPRESSIVE PROFIT MARGINS

Based on the dynamics of revenues, this is a stable business that has been consistently demonstrating about $130 billion over the course of five years, having the net profit of around $19 billion.

Earnings per share are $4.65. With the current P/E of 10.81, Verizon is undervalued. Let's take a look at the quarterly reports. The last five reports demonstrate a stable figure of about $1.2. In April, the price is expected to reach $1.22. Since this is not a services sector associated with tourism, manufacturing or aviation, I don’t believe that the coronavirus situation would take a great toll on these figures.

So, based on the latest reports, we can expect an average price for the year to be around $4.88, which is in line with previous years. The P/E benchmark is approximately 10. Despite the unpredictability of the reporting period for many companies, the investors may still find Verizon interesting given its stable performance, solid cash flows and a high dividend rate.

Open an account and start trading CFDs on Verizon Communications stocks

The trend broke after an attempt to break out highs above 61.50 and returned back into the range of 46–54. It is clear that the instrument is stronger than the market and demonstrates lesser volatility, which may draw attention to company's stocks.

Now, as far as the stock indices go, the price will quickly return above 54.27 if there are enough current stimuli. In the event of continued pressure on the S&P 500, the 46 mark is likely to be tested. That said, the round figure of 50 is quite interesting in terms of long positions based on the fundamental analysis, stock volatility and dividend yield.

More conservative traders have to wait for a return and consolidation above 52.92 or above 54.54. In that case, the price movement potential up to the resistance level of 60.68 is appropriate.

Аutor: Viktor Makeeu