1. Accession

2. History

3. Unix or OSX as more reliable alternatives to Windows

4. Fundamental analysis

5. Technical picture

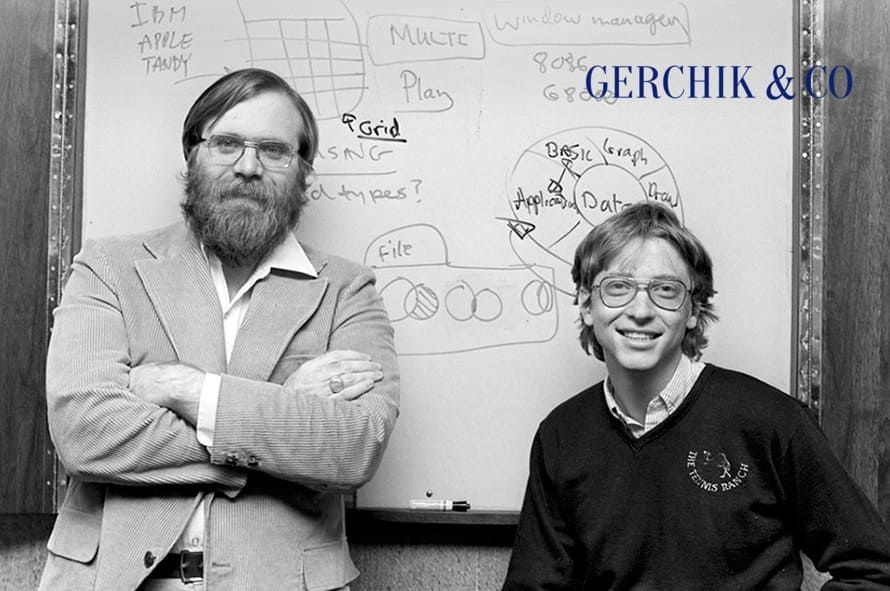

There are big companies that people who are unfamiliar with financial sector don’t know about. There are also the companies whose products people are using on a daily basis, yet don’t know much about the company itself. Microsoft is on everyone’s lips. And even if the user prefers Mac OS, he or she has certainly come across the Bill Gates and Paul Allen’s creation at one point or another.

The size of the company is truly startling. E.g. revenues of more than $100 billion can be easily compared to Ukraine’s GDP or the GDP of Belarus and Lithuania combined. Meanwhile, the value of the company with a capitalization of more than $1 trillion is such that only China or Japan can afford buying it here and now given the international reserves (assets readily available to the country's monetary authorities).

That being said, nobody will sell the hen that lays golden eggs. So, what you can do is treat yourself by buying the company’s shares, or settle for treasury bonds like China does.

Only imagine that it’s enough to ‘just’ come up with a solution like Microsoft or a few successful startups, and the country will be living securely without paying much attention to subsidized and unpromising projects.

When analyzing such giants as Microsoft, we have to admit that the former Soviet Union countries have fallen behind miserably. The best minds are leaving for greener pastures (the example mentioned in the previous article covering GOOG is not the only one), while the local research is desperately trying to show off the accomplishments of the remaining patriots for peanuts.

Here are some figures regarding the research costs provided by the Institute for Statistical Studies and Economics of Knowledge:

In order for such companies to emerge, there has to be a favorable environment for that. But let’s get back to Microsoft, shall we?

.jpg)

In 1975, two students, Bill Gates and Paul Allen, developed the Altair Basic interpreter for the BASIC language which was meant to run on the MITS Altair 8800. BASIC itself was designed by Dartmouth College professors Thomas Kurtz and John Kemeny as a tool that the non-programmers could use to write programs to tackle their tasks.

It is believed that this system became a turning point in the development of personal computers, and the demand for the Altair 8800 skyrocketed. Instead of the anticipated 800 computers a year, there were 12,000! The MITS Altair 8800 was invented by Henry Edward Roberts, an American entrepreneur, engineer, and medical doctor.

Such popularity of the software became the foundation for Microsoft's massive success. Interestingly, BASIC was heavily criticized.

«It is practically impossible to teach good programming to students that have had a prior exposure to BASIC: as potential programmers they are mentally mutilated beyond hope of regeneration.»

However, this did not stop Gates and Allen from signing a contract with MITS, as well as ending their first year with a bang and a turnover of $16 thousand for three. Gates was obsessed with the project and was ready to give Microsoft all of his time. According to Bill himself, he has been crazy about computers since school years, would skip PE, and code all night long and over the weekends.

Having sensed demand for Basic, Gates went with his gut by making deals with General Electric, Citibank and NCR. The fact that the third-party computer manufacturers would get their hands on the Basic interpreter didn’t sit well with MITS company, for nobody wishes to let go of the captured market share.

This issue made it to court, and the contract with MITS was terminated based on insufficient efforts to promote the Altair Basic product. In 1978, Microsoft developed programming languages for Intel 8080-based platforms. This was no longer a startup. The company was taking the roots which would be capable of surviving any competition hurricanes.

In 1983, the company started manufacturing MS-DOS created by Tim Paterson at Seattle Computer Products. It is hard to believe but it took him only six weeks to develop it! 1983 was also the year when the founders of Microsoft parted ways.

«My partner wished to get as much as possible and not to let anything slip out of his hands. I could not come to terms with this... And this is when I thought that at some point I would have to leave.»

That said, Allen kept his position on the board of directors, and sold a portion of the shares at $10 each. Today, their value is over $150.

With the emergence of Microsoft Windows as a GUI add-on to DOS, 1985 became a landmark year for the company. In 1987, Windows 2.0 and OS/2 developed jointly with IBM came along. Partnership with IBM allowed capturing over 90% of the world's personal computers by 2008.

But was everything going smoothly for the company? Is Windows the most popular OS? And wait, where are the competitors? This is by far one of the most interesting questions that needs to be answered in order to make any sensible forecasts about the company’s future, its share and turnover…

.jpeg)

Unix was created in the 1970s at the Bell Labs research center by Ken Thompson and Dennis Ritchie based on the ideas of the original AT&T project. It has a modular design where each task is handled by a separate utility, and interaction is done through a single file system.

The key difference that makes it stand out among other systems is multi-user multi-task systems and multiplatformity. In other words, Unix can be adapted to almost any microprocessor. It is used primarily in servers and in-built systems for equipment.

Another famous projects within the Unix family was Linux developed by Linus Torvalds back in 1991. I remember at one point I wanted to install it too in order to go off the beaten track.

Unlike commercial operating systems Windows or Mac OS, Linux does not have a particular geographical location and essentially is decentralized in nature. What it means is that Linus is the result of thousands of projects. Open source allows reducing the development costs of closed-source systems for Linux. It has become a leader in the server market with a market share of over 30% (since the UNIX share is over 60%), and is holding a third place in the personal computer market with a share of 1% to 5%.

The key problem of both Unix and more adapted Linux lies in the limited target audience. UNIX missed a chance to make it truly big when in the 80-90s this OS was significantly better than Windows, but it could not support a lot of peripheral hardware, plus the price was pretty high. On top of that, configuration of a Unix-based computer would seem like a rocket science to a regular user. So, it is likely that Basic that Bill Gates started with was simply easier for an average person.

As far as the brainchild of Apple and Windows competitor goes, Mac OS scored second place on the list of operating systems. According to StatCounter, the share of Mac OS is 15.83%, with the most popular being MacOS Mojave.

But why Windows again? Let's start with the hardware updates that Steve Jobs was not supportive of at the very founding stage. He wished to create a completely closed-source system. Period. Unlike Apple OS, Windows allows changing video cards, rebuilding the components entirely, and adding RAM. This doesn’t work with Apple: you just have to get a new device once your previous gadget gets outdated.

Compatibility with various devices is also not as great as in Windows. A big gaming community prefers Windows from support standpoint. Perhaps, Apple has a technological breakthrough in store for the users and is only waiting for the right time to unveil it. However, as of today, Windows (and Microsoft) remains a true market giant, leaving the competitors no chance to beat it.

That being said, there is an even more popular OS niche that Microsoft forgot or “missed” to capture. It is the smartphone and tablet market where Android remains to be one of the major pillars, just like Windows in the PC market. But only time will tell whether the companies will try to peek into each other's pockets that generate profit...

Open an account and start trading CFDs on stocks of the world’s top companies

With 4.47%, MSFT holds the largest share in the S&P 500. Unlike Alphabet Inc, it pays dividends of 1.30%, which is lower than the general market dividends amounting to 1.75%.

Profitability indicators are also startling, with the return on total assets being above 15%. From 2015 to 2019, revenue has increased from $92 billion to $125 billion, i.e. an average of +8% per year. Net profit tripled from $12 billion to $39 billion over the same time period.

Given the company's market position, the market players are obviously optimistic about it.

However, we are yet to find out how overrated MSFT is. Will the expectations meet reality and when will this happen? Let's take a look at the latest quarterly reports.

The latest reports are pretty stable and exceed the expectations of the analysts. A slight slowdown up to a $1.32 profit per share is expected with the release of the next report. That said, the company generally maintains the price level of $1.30 per quarter i.e. the annual expectation benchmark being $5.2 per share.

Let’s assume that the company will continue to maintain this growth rate and will achieve $1.5 per quarter over the course of a year (I do not think it is going to be more than that given the dynamics). Therefore, it will be $6 in a year. In other words, we get about $5-6 in a year for the next year or two.

As a matter of fact, $5 a year is the result of 2018. At the current price of $157 P/E with an EPS being $6, it is about 26, which is higher than the median 15 i.e. the overbought is not huge, but already considerable. In order to justify current prices, MSFT needs to achieve annual profit of $10 per share and over $2.6 for the quarter, which is far from reality.

Basically, the company has to double the profit. The sales market is generally firmly established, the shares are mostly determined and are in favor of MSFT. So, I believe the company won’t be able to create similar dynamics in the next year or three like it did in the beginning. In terms of the fair price, it is around $75–90 according to the current reports. However, it still makes sense to take a look at the technical picture.

From a technical standpoint, there is a huge gap till 75–90, and in order to get there, there has to be a considerable market correction, and not even by 10-15%. Negative forecasts in the reports could be the second option. Due to this, the market players would no longer hope that current results could double or triple.

As far as the realities go, the correction up to 131 seems quite possible, but still uncomfortable from the fundamental standpoint. To achieve this, the EPS figure should be about $2 per share. Meanwhile, a retest of the round price at 100 could be a real chance. By the way, this is where the price has already been in 2018. In this regard, it is enough for the EPS to reach $1.66, which is quite realistic).

In other words, an attempt to buy at this point can’t be treated as a cost calculation and would be more of a speculative idea. Locally, the instrument exited the 131–142 range. The ship has long sailed with no chance of catching up with it. Even from a speculative standpoint, it makes sense to just slow down. This is what the market that has been pushed up high using all kinds of ways is like right now.

Author: Viktor Makeeu