By investing in assets, you embark on a path of running a successful business. Companies issue shares, bonds, or a combination of the two to purchase certain assets.

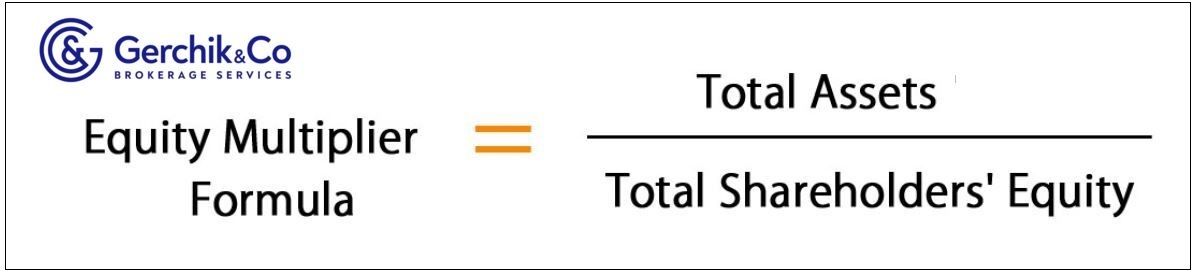

Equity Multiplier, also known as Financial Leverage, Equity Ratio, and Leverage Ratio, is a risk indicator measuring the part of the company’s assets that employ equity financing rather than debts.

Equity Multiplier = Total Assets / Total Shareholders’ Equity

1. Total Assets for the quarter ended in September 2020 totals $40,551.

2. Shareholder’s Equity for the quarter ended in September 2020 totals $22,661.

3. Let’s measure Equity Multiplier for the quarter ended in September 2020:

Equity Multiplier = Total Assets / Shareholder’s Equity = $40,551 / $22,661 = 1.79.

NEM’s multiplier helps find out that a business isn’t overly leveraged. NEM indicates a healthy Equity Multiplier of 1.79. NEM’s asset financing structure is conservative.

This means the following: NEM faces less borrowed funds. Most of the assets employ equity financing, while debt takes a minor portion. NEM uses 44% of debt to finance assets:

((40,551 − 22,661) / 40,551 x 100) = 44%

4. From a dynamics perspective, NEM’s Equity Multiplier has been dropping since March 2019 (1.99). The indicator has increased a little bit, reaching 1.80 over the last quarter ended in December 2020.

5. If we compare it with a peer with similar capitalization (Barrick Gold Corp#GOLD), we can see that Equity Multiplier is 1.99. Here’s a standard case: the indicator of 2 means that half of the company’s assets use debt, while the other half uses equity.

Open an account and start trading CFDs on top stocks

1. Equity Multiplier enables you to find out how well a company can meet its debt obligations, i.e., how many assets investors will ultimately get (once all debts have been paid off).

2. Traditionally, equity financing is cheaper than debt financing. But for some companies, high Equity Multiplier values don’t always equal significant investment risks. Widely used debts can be part of an efficient strategy that enables a business to purchase assets at a lower cost. This is the case when a company believes that it’s more profitable to raise debts as a financing option rather than to issue shares.

3. If a company has used its assets efficiently and makes a profit that’s high enough to service debt, then debt can be a benefit. But this strategy can cause a company to suffer from a sudden profit slump, which could make it hard to pay off debt.

4. Low Equity Multiplier values aren’t always a positive indicator. In some cases, this may show that a company can’t obtain credits and its growth prospects are low due to low financial leverage.

5. Equity Multiplier is irrelevant in isolation. You, as an investor, must do trend and industry analyses to find out how well you understand the debt position in the aggregate.

⇐ Key to making money with shares. Lesson 21. Debt to Capital. Newmont Corporation Key to making money with shares. How to pick stocks ⇒