We continue flipping the pages of our ABC book of trading. We have already discussed types of positions, ways to calculate them, and the expected value.

In today’s article, we are going to shed light on the orders that are used when trading in the foreign exchange market.

Forex order is a way to open and close trades in the market by telling the broker their parameters such as trade direction, volume, price, etc.

1. It’s Easy to Choose Forex Order

2. Market Order: Definition

3. What Kind of Pending Orders Are There

4. How to Use Stop Order

5. Order Usage

The most important thing is to know what orders exist and how they differ. It must be noted that the types of orders depend on your trading platform. When trading forex, these typically are MetaTrader 4 and MetaTrader 5.

Forex orders can be roughly divided into three categories:

1. Market orders

2. Pending orders

3. Stop orders

Below, we are going to examine each one separately.

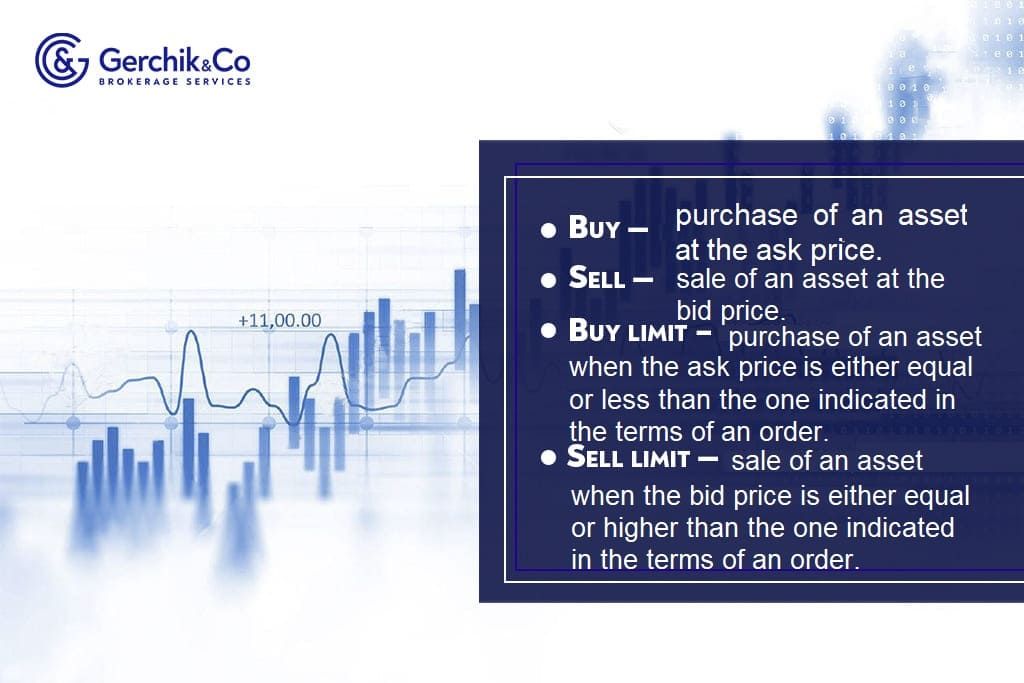

A market order in forex is an order to sell or buy a financial instrument at the best available price. This group of orders includes:

.jpg)

The pending order is used when the suitable terms for the trade haven’t manifested themselves yet but the trader’s forecast points to the fact that they may appear over time. When this is the case, the broker is given an order to open a position with an indication of specific terms and the price, upon reaching which a long or short position must be opened.

Pending orders in forex allow you to open the trades when you aren’t on your computer.

1. Buy Stop limit is an order to place Buy Limit when the ask price reaches the value indicated in the “Price” section. In this order, you also need to indicate the level of the opening price of the Stop Limit.

2. Sell Stop Limit. The situation here is similar to the previous order just in the mirror image. Sell Stop Limit is an order to place Sell Limit when the bid price reaches the value indicated in the “Price” section.

Stop order is an order placed with a broker to close the trade when certain conditions are met. There are three types of stop orders: Stop Loss, Take Profit, and Trailing Stop.

1. Stop Loss is essentially an order which limits the losses. With this order, the trader requests to close a losing position when the price reaches a specific value.

FUN FACT:

Stop Loss is the key “protector” of the trading account. It allows you to observe one of the basic trading rules, “Cut your losses short, but let your profits run on.” By using this type of order, you can control risks per trade and overall profitability of the trading strategy.

2. Take Profit is a limit order that is closed when a specific profit level is reached.

3. Trailing Stop is basically a floating stop loss. Depending on the situation, this stop order may serve as stop loss or take profit. It must be placed at a certain distance from the price of the stop loss.

This is how the stop order works:

PLEASE NOTE:

Keep in mind that the trailing stop works only in an active trading terminal! If you need to exit the terminal or shut down your computer, it’s best to replace the trailing stop with a regular stop loss.

Watch this video to learn more about rules for placing trailing stop or stop loss.

It must be noted that market orders get triggered right away since they are placed at the current price. Pending orders will either just stay there until they get executed or remain set but abandoned. So, make sure to remove all pending orders that you don’t need anymore.

Stop orders allow managing risks and profits. It is important to use them but it has to be done correctly if you wish to trade safely and profitably. In our next article, you will learn how to choose the right type of order.

Wish to learn how to trade forex profitably?

Complete a training course based on Aleksander Gerchik’s system!

Learn more