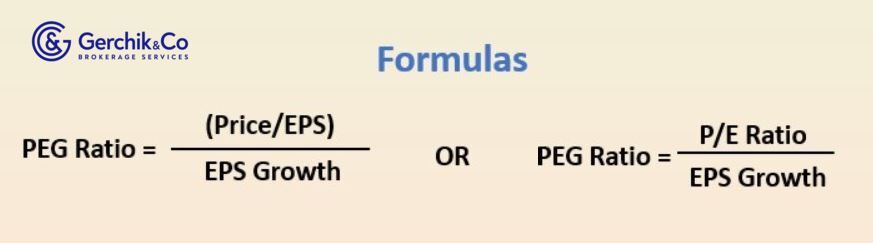

PEG ratio (price/earnings-to-growth ratio) is a measure used to determine the fair value of stock in the future. As we already know, current earnings are used to estimate the P/E ratio. But when it comes to PEG, we apply future earnings expectations.

The numerator of this ratio is the P/E. Price/EPS determines how many years it will take for the investment in a particular company to recoup given current capitalization. The denominator is the projected growth in net profit for the year which is a subjective estimate made by analysts based on a comprehensive analysis of the company.

Peter Lynch, a former manager at Fidelity Investments and author of One Up on Wall Street once wrote:

«P/E ratio of any company that’s fairly priced will equal to its growth rates. In other words, the PEG of the fairly valued company will be 1».

If Coca-Cola’s P/E is 15, we can expect that the company will grow by about 15% per annum. However, if the P/E is less than the growth rate, you may have found yourself a great deal. Let’s say, a company with a growth rate of 12% per annum and a P/E ratio amounting to 6 is considered to have appealing prospects, whereas the growth rate of 6% per annum and P/E of 12 is not.

Generally speaking, the P/E ratio that is half the growth rate is believed to be a very positive sign while the ratio that is twice the size of the growth rate is deemed very negative.

1. What makes PEG different from other key indicators is that it is analyzed based on both data obtained from financial statements and subjective forecasts.

2. Once you determine P/E per share, you will be able to calculate the price/earnings-to-growth ratio. The PEG ratio compares the current price of the company's stock to its current earnings per share. After that, it measures the P/E ratio relative to the rate at which the company's earnings are growing.

3. PEG ratio provides a deeper insight into the projected value of the investment. Extremely high P/E will not be the most significant factor as soon as you estimate the company’s growth rate.

4. PEG offers more advantages as compared to the calculation of the P/E ratio. The P/E is considered on a case-by-case basis since this indicator only factors in the value of the company in terms of its current earnings.

5. The PEG ratio provides a clear understanding of how expensive or cheap a company's stock is relative to its current growth rate and how it is expected to grow in the long run.

1. The ratio is typically used to measure the fair value of shares. You can obtain relevant figures from various publicly available information sources. E.g. ycharts.com, seekingalpha.com, etc.

2. PEG is based on the assumption that the P/E ratio is directly correlated with the expected growth rate, i.e. PEG is constant.

3. In the case of higher growth rates, PEG ratios are stable and less sensitive to changes as compared to P/E ratios. This makes value growth ratios more suitable for the evaluation of companies with high growth rates.

4. The PEG ratio is used to estimate the value of growing companies where prospects for development are assumed to result from reinvestment with maximum returns or through enhancement of efficiency. The US technological sector can serve as an example.

5. PEG is less suitable for the estimation of companies that do not have high growth rates. Large, reputable utility or infrastructure companies can provide you with reliable dividend income. However, they have few opportunities for growth.

PEG = 1 — Fair Value PEG < 1 — Company is undervalued PEG > 1 — Company is overvalued

Basically, a lower PEG indicates that the company is currently undervalued based on its earnings metrics, whereas a higher rate means that the company is overvalued for the time being. In other words, for an accurate assessment, it must correspond to the growth rate of earnings per share or be equal to 1.

P/E of Company А = 10, Expected Earnings Growth Rate = 4%. Hence, PEG = 10/4 = 2.5.

Given the optimal value of PEG < 1, it is safe to say that the company is overvalued.

With that said, if a company has demonstrated stable growth in the past, a high P/E ratio already looks different. This is why we recommend that you consider the investment from all angles, and, perhaps, invest in a more expensive stock that has solid prospects.

Let’s get to the bottom of this using real-world examples of biotechnology companies:

The company is fairly expensive at the moment but there are prospects for further growth.

The company appears to be currently overvalued.

On the other hand, it is believed that the fundamental interpretation of indicators is not illustrative. An increase in the shares on the market does not equal the projected earnings growth.

Facebook. PEG of 1.62 looks appropriate as far as this company goes. Based on the comprehensive analysis, it can be concluded that the company is not overvalued.

Open an account and start trading CFDs on stocks of successful companies

⇐ Key to making money with shares. Lesson 3. P/B Ratio Key to making money with stocks. Lesson 5. P/E Ratio ⇒