1. Founding and Evolution

2. Fundamental Analysis

3. Technical Analysis

There’s nothing new I can possibly reveal about this Company’s products to those who personally set up computers or understand their internal workings. This article might urge you to check out the “insides” of the system unit or at least to explore the settings of your electronic friend’s components. It is also likely that many of you will discover specifically Intel components inside of it. And if so, you will appreciate the scale of this company’s operation.

It may not be Microsoft, its competition may be much tougher, but this is still a global giant. Its range of products includes microprocessors, chipsets, and computer components.

No wonder that the shareholders that issue the largest ETFs (i.e. exchange-traded funds) have shown interest in it. These are in particular:

Just Vanguard Group Inc. alone owns shares worth over $15 billion. And the company itself is estimated at $246 billion.

Intel was founded back in 1957 by integrated circuit developers Robert Neuss and Gordon Moore. Initially, the company was registered as NM Electronics but later was renamed to Intel which stands for Integrated Electronics.

After presenting a one-page business plan, Intel received a $2.5 million start-up capital! This was enough for venture financier Arthur Rock. What happened next was development of semiconductor memory, and 3101 Schottky bipolar memory chip. In 1969, Intel 1101 became the first mass high-volume metal-oxide semiconductor (MOS). 1 Kb dynamic memory chip saw the light of day in 1970. In 1971, engineer Ted Hoff suggested integrating all of the elements into a single chip. This is how the world's first commercially successful Intel 4004 microprocessor was released.

The fifth-generation Pentium with a speed of 100 million operations per second was introduced in 1993. It was over a thousand times faster than its predecessors. By 1996, the company commanded a 40% market share of the motherboard business. In 2000, the 1 GHz Pentium 3 processor and Itanium, the company's first 64-bit processor was released.

Fun fact, Apple has been using Motorola processors since 1984, but then switched to Intel chips in 2005.

This was then followed by an acquisition of a well-known antivirus McAfee for $7.68 billion. In 2015, Intel bought Altera for $16.7 billion, and Mobileye, Jerusalem-based developer of advanced vision and driver assistance systems, for $14.9 billion in 2017. Naturally, an intense competition in the microprocessor market continues. The company is forced to implement corporate restructuring (apparently due to information leaks) and even ban any communication with Huawei employees.

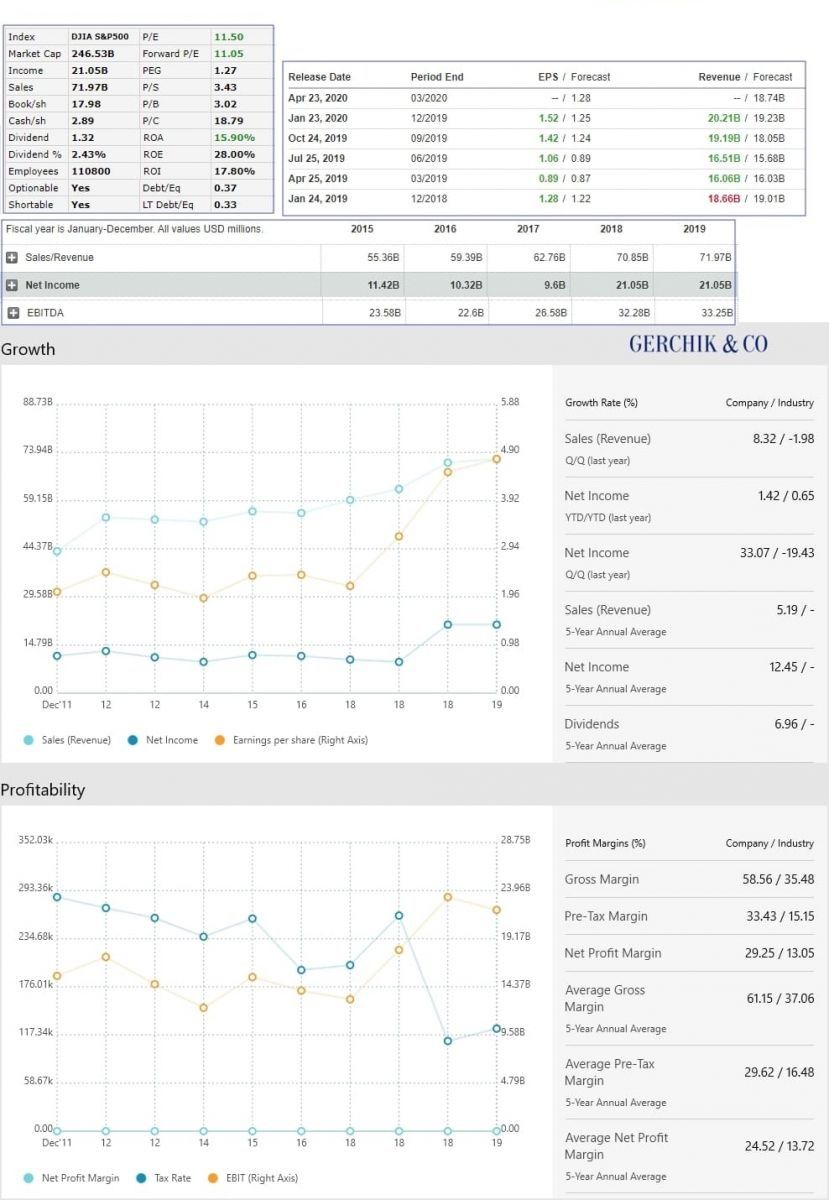

Intel is indeed a very powerful technology company which demonstrates solid profit margin figures:

PROFIT MARGIN INDICATORS SPEAK FOR THEMSELVES:

Unlike many companies from this sector, it pays monthly dividends at the rate of 2.43%. This is higher than market ones of 1.95% by SPY.

The company is not overindebted, has a solid cash flow margin and is not institutionally overbought. During the time period from 2015 to 2019, the revenues grew from $55 billion to $71 billion. Net profit is unlikely to remain at the level of $21 billion for two years. According to EBITDA margin measures, it is apparent that the growth has not been huge in recent years, but still consistent enough. Let’s take a look at the quarterly reports. The price swings from $1 to $1.5, but is about $1.2 on average. Being about $4.5–4.7 per share annually, the price basically remains the same as in 2018 and 2019. With the current price, P/E is about 11. Even if the reports go downhill against the backdrop of the coronavirus pandemic and the price drops to $4 per annum, P/E of 13 will still be underestimated.

Against the backdrop of the situation with Covid-19, a lot of companies have already revisited the levels of 2008. The crude oil industry took a major hit too. Although INTC has lost more than 35% of its highs. However, it is still nowhere near the levels of 2008 i.e. $12. It is also clear that the issuer has not lost its interest, and the price of 43 served as a deterrent.

Interestingly, the price went to 15 in terms of P/E i.e. at a price of around 69. Locally, it was maintained at 45.33. At the moment, there is an ongoing fight for 55.73. This is where the buyers seem pretty confident.

Currently, the market is approaching quarterly reports. Many people see this as a total nightmare since it is hard to predict anything and make any estimates in advance. That said, danger always looks bigger through the eyes of fear, and you will later have to catch up.

Аutor: Viktor Makeeu