The three Indians pattern is known to many traders as the “three-drive pattern” but is also referred to as the “1-2-3 pattern” and “three touches.” When it appears in the chart, it provides a powerful signal for the trend movement that is clear even to the newbies. In today’s article, we are going to discuss the principles of its usage.

1. Three Indians Pattern: Ways to Recognize It

2. How to Trade Three Indians Pattern

3. Three Indians: Trade Case

4. Three Indians and Linda Raschke

The Three Indians technical analysis pattern looks like three touches (three bounces) from the inclined trendline. Bearish and bullish types of this pattern are distinguished.

You should look for this pattern on the hourly and daily time frames since that’s where it works out best.

Three Indians pattern can provide signals for entry into long positions (in case of the bullish pattern) and short positions (where it’s bearish).

1. The position is opened from the third point of the touch and reversal from the trend line towards the trend only.

2. It is important to wait until clear bounce forms. It is dangerous and too early to open a position and place pending limit orders when approaching the trend line.

3. Ideally, the stop loss should be placed behind the second point of touch. At the same time, the ratio between the stop loss and take profit per trade should be reasonable (at least 1:2). If there is no way to achieve that, you can place your stop loss slightly above or below the third point of touch in the bearish/bullish pattern. However, you will need to receive additional technical signals for this.

4. Take profit should be placed near the previous high when it comes to the bullish pattern and near the previous low if you are dealing with the bearish pattern.

NOTE:

It stands to mention that the bounce from the third point doesn’t necessarily work out every single time. The price may return to the trend line and subsequently break it out.

1. The Three Indians pattern must not be the only reason for opening the trade. Look for the confirmation of your entry’s accuracy using other methods of chart analysis.

2. Check out whether there are any strong technical levels or any other formations within the pattern or beside it. For example, you may see the three Indians pattern which turns out to be a part of the triangle, the exit from which can happen in any direction.

With technical analysis patterns, it becomes easier to read the charts. The tried-and-true patterns are subject to the most important market law—things repeat themselves. You can learn about key patterns and ways to perform a market analysis the right way by starting the free training in the messenger of your choosing today.

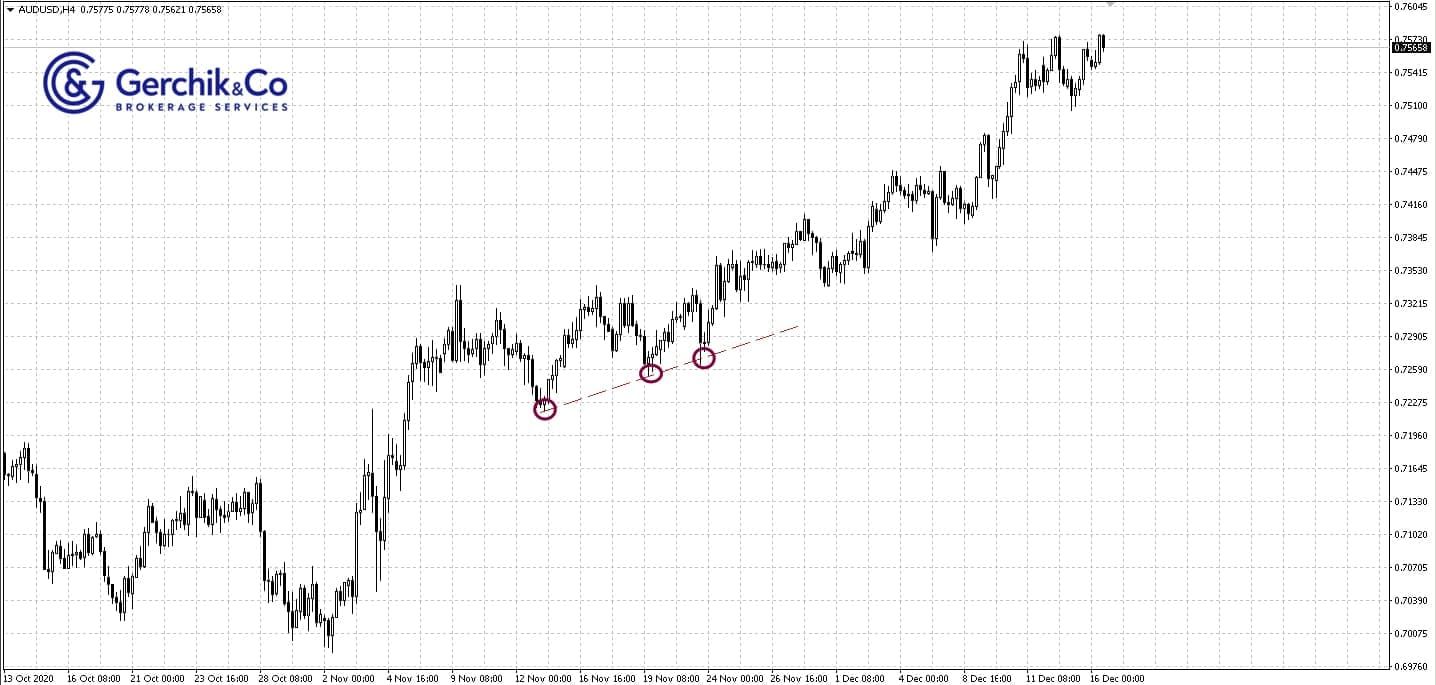

As previously mentioned, the Three Indians pattern is best coupled with other market analysis methods e.g., as an additional signal when trading levels. Let's consider the example of this illustrated by a situation in the 4H chart of the AUD/USD currency pair.

1. The horizontal levels strategy is used to make trades.

2. We notice the bearish Three Indians pattern forming in the chart. This means that we should go short when there is a third bounce downward.

3. Before opening a position, we consider levels and realize that:

The Three Indians pattern once again proves that it is better to “trade with the trend.” That is why the Forex newbies love it so much. Its signals are clear and confirm the well-known statement that "the trend is your friend."

The traders who prefer this pattern have different views on the methods for identification of this pattern, in particular on how to draw the trendline. It is believed that Linda Raschke was the first to describe the Three Indians pattern. However, there are discrepancies even among those who mention her in their blogs.

Some traders draw the line along successively rising lows in an uptrend and successively falling highs in a downtrend, as described in our article earlier. The Three Indians pattern is compared to the ABCD pattern.

Others note that the Three Indians in the uptrend are three successively rising highs located on the same line, or three successive lows in a downtrend.

With that said, all of them emphasize the need to couple this pattern with other market analysis methods. At the end of the day, this pattern works for everybody and that’s what matters.

Now, if you wish to get to the bottom of the Three Indians pattern and figure out yourself who is right, after all, make sure to check out the primary source i.e. Linda Bradford Raschke’s book "Millionaire Stock Secrets" if you haven’t done so already.