We continue with the series of our articles dedicated to forex graphical analysis.

Quasimodo pattern is one of the reversal patterns of the graphic analysis. It looks slightly similar to the Head and Shoulders pattern. However, upon closer inspection, you may notice significant differences. The entry point is also not the same. In today’s article, we are going to explore the ins and outs of this pattern.

1. How Does Quasimodo Pattern Look and Form

2. How to Trade Quasimodo Pattern Upon its Emergence

3. Quasimodo Forex Indicator: Identifying the Pattern Automatically

This graphic pattern points to a trend reversal. This is why you should only look for it when there is an ascending or descending channel in the chart. The presence of similar patterns in the sideways market essentially doesn’t mean anything.

How to recognize the Quasimodo forex pattern:

1. It is typically in the ascending (bearish Quasimodo) or descending (bullish Quasimodo) trend.

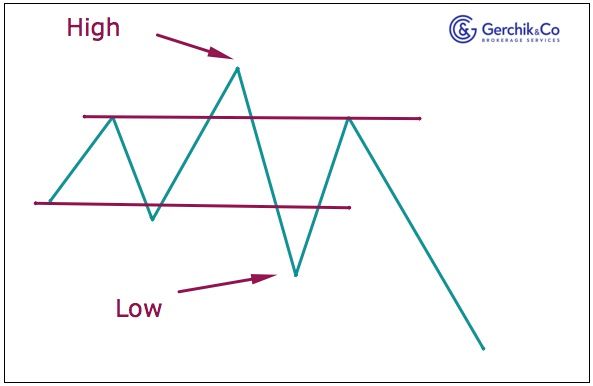

2. Bearish Quasimodo forms once the previous low gets updated at the price rollback after the high has been achieved (similarly to the Head and Shoulders pattern where the neckline is broken out).

3. As far as the bullish Quasimodo goes, the high gets updated and the price rolls downwards again as soon as another low is achieved in the downtrend.

From a visual perspective, the Quasimodo forex pattern looks similar to the Head and Shoulders pattern, yet the said shoulders are even. This peculiarity is what presumably gave this pattern its name.

1. We enter the counter-trend trade i.e. at price reversal. In the downtrend, we buy and sell in the uptrend respectively.

2. In the case of the bearish Quasimodo pattern, we open a short position when the price reverses downwards for the third time at the third shoulder.

3. When there is a bullish Quasimodo pattern, we take the same steps but in mirrored fashion—we open a long position at the third low.

If you are new to trading or still relatively unfamiliar with the way QA looks in the chart, you can use the Quasimodo pattern indicator to help you out.

It is not included in the standard set of MetaTrader 4 tools and needs to be additionally installed. That being said, you shouldn’t fully rely on the Indicator alone. Make sure to use it only as a cue. Otherwise, you should be able to find the right entry point and levels to set your stop orders on your own.

In our next article, we are going to discuss the Cup and Handle pattern.

Login in Personal Account