This lesson is going to investigate the third short-term liquidity ratio that you won’t often find at exchange websites and when doing fundamental analysis (like Current Ratio and Quick Ratio). Nevertheless, the above ratio will give you a complete idea of any company’s liquidity.

Cash Ratio/Cash Asset Ratio/Liquidity Ratio is a measure of a company’s quick liquidity, i.e., whether a company can settle all of its obligations without having to sell any stocks.

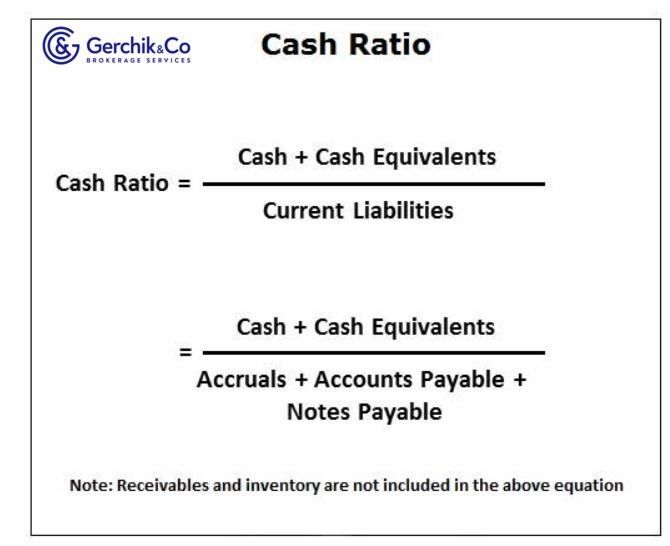

You can calculate this indicator by dividing the total amount of cash and cash equivalents by the amount of the company’s current obligations.

Cash Ratio is the most conservative of all three short-term liquidity ratios: current (Lesson 30), quick, and cash.

The point is that it factors in only the most liquid assets—ignoring receivables and inventories—out of all the company’s short-term assets that can be used to settle current obligations. These accounts aren’t factored in because there’s no guarantee they can be immediately converted into cash when (and if) necessary.

✅ Average interest rate on deposits per annum — 10 %

✅Trader’s average annual profitability — 50-100 %

Open an account and make more money than in the bank!

When using Cash Ratio, you should pay attention to the following nuances:

1. Cash Ratio shows the percentage of the company’s current obligations to cover cash and cash equivalents.

2. A ratio that’s higher than one means that a company will be able to settle its current obligations; besides, it’ll have funds left over.

3. Cash Ratio that’s higher than one means that all current obligations can be paid in cash and cash equivalents.

4. Lenders prefer a high ratio because it shows that a company can easily pay off its debt.

5. Although there’s no ideal value, a ratio from 0.5 to 1 is generally preferred.

6. We can’t say that any ratio above one is a decent liquidity indicator. This may show that cash is insufficiently used to generate more profit.

7. Note that Cash Ratio doesn’t necessarily ensure that you do a good financial analysis, as companies don’t usually hold cash that equals their current obligations. If there’s a lot of cash on the balance sheet, this means that a company is using its assets irrationally, as its cash won’t generate profit in this case. Usually, companies reinvest their surplus cash to make sure shareholders receive higher returns.

Cash Ratio Formula = Cash + Cash Equivalents / Total Current Liabilities

1. Let’s calculate the ratio for quarter ended in December 2020:

Cash Ratio = Cash and Cash Equivalent / Current Liabilities = $1,856,394 / $3,635,880 = 0.51 (51%)

2. Let’s calculate the ratio for quarter ended in March 2021:

Cash Ratio = Cash and Cash Equivalent / Current Liabilities = $862,720 / $3,204,949 = 0.27 (27%)

Evidently, MercadoLibre could repay 51% of its current obligations in December by using its cash and cash equivalents, while the ratio dropped to 27% in the next quarter. That’s not a decent indicator, but you should work on this case.

3. MercadoLibre’s Cash Ratio is lower compared to peers in the e-commerce industry.

Open an account and start trading CFDs on best companies

You can find the column Restricted Cash and Cash in the report (like in our example).

What is it? These are funds that are held by a company for specific reasons and can’t be immediately used for regular business purposes. They can be contrasted with unlimited funds to be used for any purpose.

Usually, you can find the reason for any restriction in the related notes to the financial statements. Besides, this item can be attributed to current or non-current assets, depending on the restricted cash period.

Since the funds from this column aren’t available for use, some liquidity ratios usually don’t take them into account. If they’re factored in, a company will appear more liquid than it actually is. Therefore, this ratio can be misleading. The examples of liquidity ratios that don’t take into account restricted cash are Cash Ratio and Quick Ratio.

1. A higher Cash Ratio doesn’t necessarily show that a company does well, especially if its value is higher than the industry average.

2. A high Cash Ratio may prove that a company isn’t using cash efficiently or isn’t maximizing the potential benefit from low-cost loans. It lets money remain in a bank account instead of being invested in lucrative projects. Also, it could suggest that there are reasons to be concerned about future profit, as a company is building up a capital cushion.

3. All in all, Cash Ratio is handier when compared to the sector/industry averages and when analyzing the company’s performance over time.

⇐ How to make money in stocks. Lesson 31. Quick ratio. Amazon Key to making money with shares. How to pick stocks ⇒