A pin bar is considered one of the strong price action reversal patterns. We continue our series of articles covering figures of a graphic analysis with tips on pin bar and how to trade it.

Pin bar is a common pattern in the market signaling to enter a position. Traders who trade mixed strategies often use it and its candlestick alternatives, such as Hammer and Shooting Star patterns as an additional confirmation signal.

However, in order to profit from the emergence of the pin bar in the chart, you need to be able to identify it correctly since you may often encounter similar candlestick patterns which deceive the newbies.

Today, we are going to explore the essence of the pin bar, how it looks, how to spot it in the chart, why it forms and what strategies should be used to trade it.

1. Pin Bar in Trading: How to Determine the Pattern Correctly

2. Why Does Pin Bar Emerge

3. How to Trade Pin Bar

4. Let’s Sum It Up

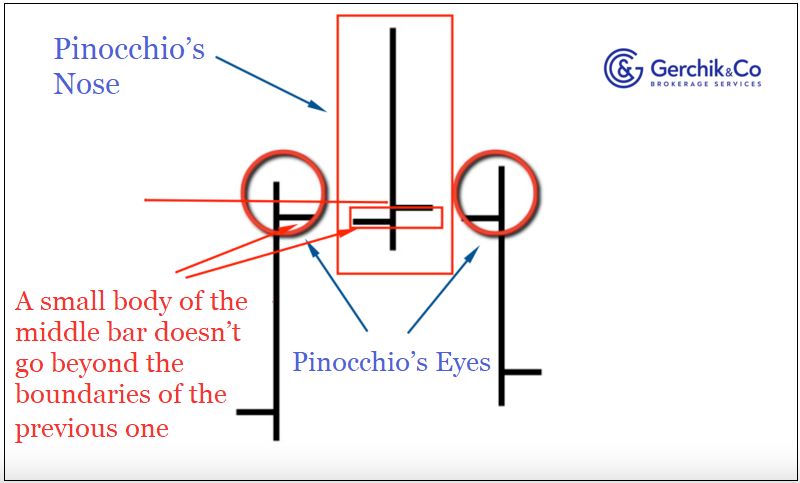

Pin bar is a pattern that consists of bars and candlesticks where the middle one has a small body and short shadow or lack thereof. The second shadow of the middle bar should be quite long. Pin bar pattern is often referred to as Pinocchio’s Nose due to the fact the shadow of the middle candlestick resembles the long nose of the fairy-tale character.

In the bullish pin bar which corresponds to the Hammer candlestick pattern, the nose will be in the form of long lower shadows, whereas in the bearish pin bar which is similar to the Shooting Star pattern, the nose will be a long upper shadow.

1. The middle candlestick should have a small body (not more than 25% of its size) and a long shadow (over 75%) which is called the Pinocchio’s nose. The opposite shadow can be either very small or be absent.

2. The candlestick on either side are Pinocchio’s eyes. The body of the candlestick in the middle must be within the limits of the outside figures beside the levels of the closing price.

3. The shadow of the middle candlestick - Pinocchio’s nose - must extend beyond Pinocchio's eyes (bodies of the candlesticks).

4. The pattern must close either near the opening price of the left eye or extend beyond the said value.

5. The emergence of the pin bar beside the technical levels, especially if its shadow formed a false breakout, strengthens the signal given by the pattern.

As we attempted to get to the bottom of the pin bar, we established that the pattern provides a reversal signal. So, what exactly is behind this pattern? Let’s check out the example of the bearish pin bar where the middle candlestick has a long upper shadow.

The pin bar was preceded by an upward price movement. Buyers pushed the price upwards until they reached a strong level. An attempt to overcome it resulted in stop-loss orders being triggered behind this level, as well as the activation of pending sell orders. The long shadow indicates that the bulls weren’t strong enough to support the price growth.

Sellers, whose pending orders got opened, now hold short positions, while the remaining market players, after seeing a bounce from a strong resistance level, also open short positions, pushing the price downwards.

The level trading strategy revealed that a false breakout of the horizontal line by a shadow is a signal of a price reversal and confirmation of the position’s strength. That is why the formation of the pin bar beside the key horizontal lines provides a double confirmation of the price reversal.

The emergence of the pin bar in the chart points to a change in the direction of the price movement. So, based on this pattern, you need to open the trade in the direction opposite to the market movement prior to that. In other words, in direction opposite to the "nose". When there is a bearish pin bar, we will go short, and when there is a bullish one, we will go long.

Also, make sure to keep two factors in mind: it is best to trade the pin bar according to the trend (you can couple it with moving averages) or from strong technical levels.

1. Pending order beyond the bounds of the short shadow of the pattern.

When this is the case, we do not wait for the second “eye” of the pattern to close. If there is a bearish pattern, you need to place a sell stop under the lower shadow once the “nose” of the pin bar closes in the chart. In case of a bullish pattern which indicates that the price will reverse upwards, place a buy stop above the upper shadow of the “nose”.

2. Rollback entry.

This position opening technique also involves pending orders, but this time these are limit orders. This type of order is placed at the level of the middle of the candlestick which forms the "nose". With a bearish pattern at this level, we place a sell limit, and a buy limit in case of a bullish one.

3. Level-based entry.

As previously mentioned, the best time to open trades based on a pin bar signal is when it is formed beside a strong level. When a bearish pin bar forms below horizontal resistance, you can place a pending order right below the level. In case of a bullish pin bar, place a buy order above the support level near which the pattern is formed.

The pin bar strategy also includes trade exit rules. You need to place a stop loss behind the long shadow of the pattern. If you rely on levels, then be sure to place it beyond its boundary. You can fix your profit by setting a take profit.

If you trade levels, focus on the nearest support or resistance. If there is no level, calculate the value of the stop loss and place the take profit that is twice or thrice its size (experiment with the take profit size; it may vary depending on the traded pair).

When developing a trading plan based on this strategy, make sure to take screenshots of successful trades. You will need them when creating your trading plan, and will have a clear picture of what a perfect trade based on a pin bar strategy and correct entry point look like.

The pin bar is one of the popular candlestick patterns that are quite easy to spot in the chart. It is formed due to the specifics of the market players’ behavior and is evidence of a price reversal. Patterns formed beside strong levels (especially those that are false breakouts of strong support or resistance) provide you with perfect signals to open positions.

Learn how to develop trading plan the right way here.