«Something must be happening on the market every day. I think I’m missing something. I’ve gone through the entire list of assets and haven’t found anything. Perhaps I should pay a closer look at the chart, examine every nook and cranny, analyze it more thoroughly again... Here you go, the market opened. Now, something will definitely come up. I just have to check it out again…»

This is what preparation and often an entire trading session of newbie traders looks like. They are new to the market, their eyes are fixated on the charts and the feeling of the thrill is taking over. And then there’s a great desire to trade something and blow off steam.

And while this eagerness remains, every day begins and ends according to the same scenario. This is incredibly exhausting. The trader makes big and small mistakes until he or she experiences a major burnout. And that’s exactly what happens in most cases.

Of course, there’s another situation when the person isn’t where they are supposed to be. There is plenty of people like that. Even as far as proprietary trading goes, traders may burn on in the course of 3-5 years while making solid money. Now imagine how fast this can happen to those whose results aren’t particularly great and they are stretched to the breaking point.

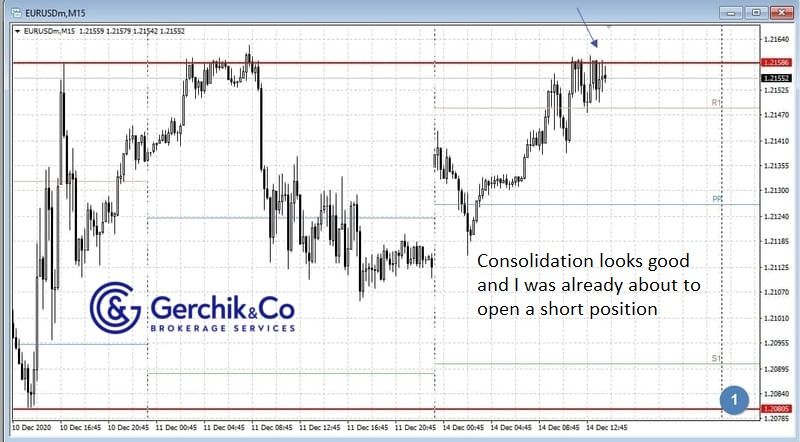

Fig. 1 illustrates the market situation for the EUR/USD pair. Visually, it may seem like a perfect scenario for someone who is trading levels. Here are bars that form the level and confirm it, and then there’s a clear holding of 1.21586.

I’m sure that there aren’t many people out there who would be able to resist the temptation to make a trade under such circumstances. But I would like to return to an important matter now. It is about the local and global evaluation of the given situation.

In Fig.2, we can see a bigger picture. The obviousness of the situation is questioning. A trained eye will be able to determine that in order to open a short position, there need to be chaotic movements around the level. Also, there is no way we can talk about holding the price.

This doesn’t mean that clear levels won’t be working out in that scenario. As we know, anything can happen in the market. We use the language of probabilities to talk about the global and local picture and the nature of the movement range.

Open a trading account at Gerchik & Co

In Fig.3, there was a fair stop loss as a result of a lack of discipline and attention to detail when making an analysis. In this type of situation, you have every right to feel proud of yourself. You’ve performed a great analysis and managed to figure out the probability against the backdrop of a clear holding of the price.

When you genuinely enjoy what you are doing this means that you are truly in your element. So, not having a position is also a decision worthy of praise.

by Viktor Makeeu

Manage your trading risks seamlessly!

Enable Risk Manager brought to you by Gerchik & Co!

Learn more about the solution