Benjamin Graham—in his well-known book The Intelligent Investor—points out that he gave consideration to companies with a minimum ICR of five. He called this figure a part of the “safety margin.” Among his analysis criteria, he focused on “the number of times total interest charges have been covered by available earnings for some years in the past.” The analyst should either focus on the average ICR over the past seven years or use the ICR for the “worst” year.

Benjamin Graham believed that a company is encumbered with debt if the ICR is less than two. An economic downturn or recession can result in a situation where a company can’t cover interest expenses.

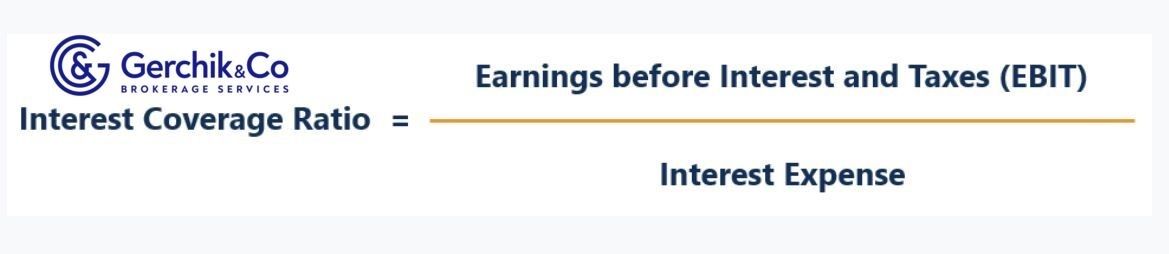

Interest Coverage Ratio = EBIT / Interest Expense

We’ll take a closer look at EBIT (earnings before interest and taxes), company’s operating profit, in Lesson 24. Interest expenses are interest payable on any borrowings, such as bonds, loans, lines of credit, etc.

1. #NFLX EBIT (Operating Income) for the fiscal year ended in December 2020 totals $4,585.

2. #NFLX Interest Expenses for the fiscal year ended in December 2020 totals:

Interest Expenses = $767 + $618 = $1,386 3. Let’s calculate #NFLX Interest Coverage for the fiscal year ended in December 2020:

Interest Coverage = EBIT / Interest Expenses = $4,585 / $1,386 = 3.31

The ICR is 3.31. That means that NFLX has a small margin of safety: the company can pay three times the amount of interest it actually has. Technically, the state of matters is “safe” in this case. But the lower the ratio, the greater the burden associated with paying interest on debts.

4. Over the last decade the minimum ICR of #NFLX has totaled 1.87, with the maximum figure being 18.78.

5. From a dynamic perspective, ICR has been borderline small since 2016. In the last year, it has dropped from 4.16 to 3.31.

6. #NFLX Interest Coverage is below the industry median value and totals 14.74.

7. Let’s compare it to the peer company with a similar market capitalization (the data is as of the time this lesson has been created):

Сomcast Corp. #CMCSA — Market Cap $248,50B — ICR 3.81

Netflix #NFLX — Market Cap $242,63B — ICR 3.31

The bottom line is that companies have equivalent ICRs.

Open an account and start trading Netflix CFDs

1. The ICR is a test of a company’s solvency. In other words, this figure measures the number of times interest charges can be covered by available earnings.

2. Higher is better. A higher ICR means that a company has a decent buffer—even after interest has been paid. Nevertheless, too high ICR may speak of a low-key approach to using external financing sources, which entails a low return on equity (without any financial leverage).

3. The lower the ICR, the weaker the financial stability. A level below 1.5 is a major red flag for a company. It shows that it can barely cover its interest expenses. Any figures below 1.5 mean that a company may not be able to pay interest on its loans, i.e., the risks of default are high. Also, it can have an extremely negative impact on the company’s image, as investors will be wary of the capital invested, while any potential lenders will shy away from providing loans.

4. Besides, if a company can’t pay interest, it can take out even more loans. Generally, that makes the situation worse and results in a loop where a company keeps borrowing more to cover interest expenses.

5. Here’s the last point. What happens if the ICR drops below one? In this case, a company doesn’t receive enough income and therefore pays more interest than its profit. That often raises the risk of bankruptcy.

1. Although we have many sophisticated analysis tools, relatively simple things will always prevail. The ICR is as simple and useful as it can be.

2. In a way, the ICR helps measure the financial stability or hard times a company may face due to its obligations.

3. Equity and borrowing are financing sources for any company. Interest is the cost of debt for a company. Analyzing whether a company can pay the price is vital to investors.

⇐ Key to making money with shares. Lesson 22. Equity Multiplier Ratio. Newmont corporation Key to making money with shares. How to pick stocks ⇒