Previously, we went over Gross Margin. Today, you will learn what Operating Profit Margin appears to be with the help of the same company—Procter & Gamble.

Operating Profit Margin measures overall profitability being used to find out the percentage of profits from business activities before taxes and interests. It’s calculated by dividing a company’s operating income by its net sales.

Operating Profit Margin is also known as operating margin and return on sales (ROS).

This indicator is widely used, so you can find out how much a company makes in terms of its operating profit.

1. Operating income. You need to subtract the cost of goods sold and other operating expenses from net sales. This shows how much profit a company makes from its core activities without any other sources of income.

Operating income is different from net income, as the former doesn’t factor in tax and interest expenses. In this regard, we clearly understand whether company's core activities are profitable before considering non-operating expenses. You can easily find Profit Margin in a profit and loss statement (P&L).

2. Net sales (Revenue). P&L starts with gross sales, i.e., a company’s total income. However, if you want to measure your net revenue, you need to subtract sales returns and allowances from gross revenue.

Operating Margin Formula = Operating Income/Revenue (sales)

Here is your data:

1. In this case, net sales are as follows:

Net Sales = (Gross Sales – Sales Return) = (360,000 – 40,000) = 320,000

2. Let’s calculate gross profit by subtracting COGS from net sales:

Gross Profit = Net Sales – COGS = (320,000 – 240,000) = 80,000

3. Let’s subtract operating expenses from gross profit and get operating income:

Operating Income = (Gross Profit – Labour Expenses – General and Administrative Expenses) = (80,000 – 20,000 – 45,000) = 15,000

4. By using the formula, let’s find out our Operating Profit Margin:

Operating Profit Margin = Operating Income / Net Sales × 100 = 15,000 / 320,000 × 100 = 4.68%

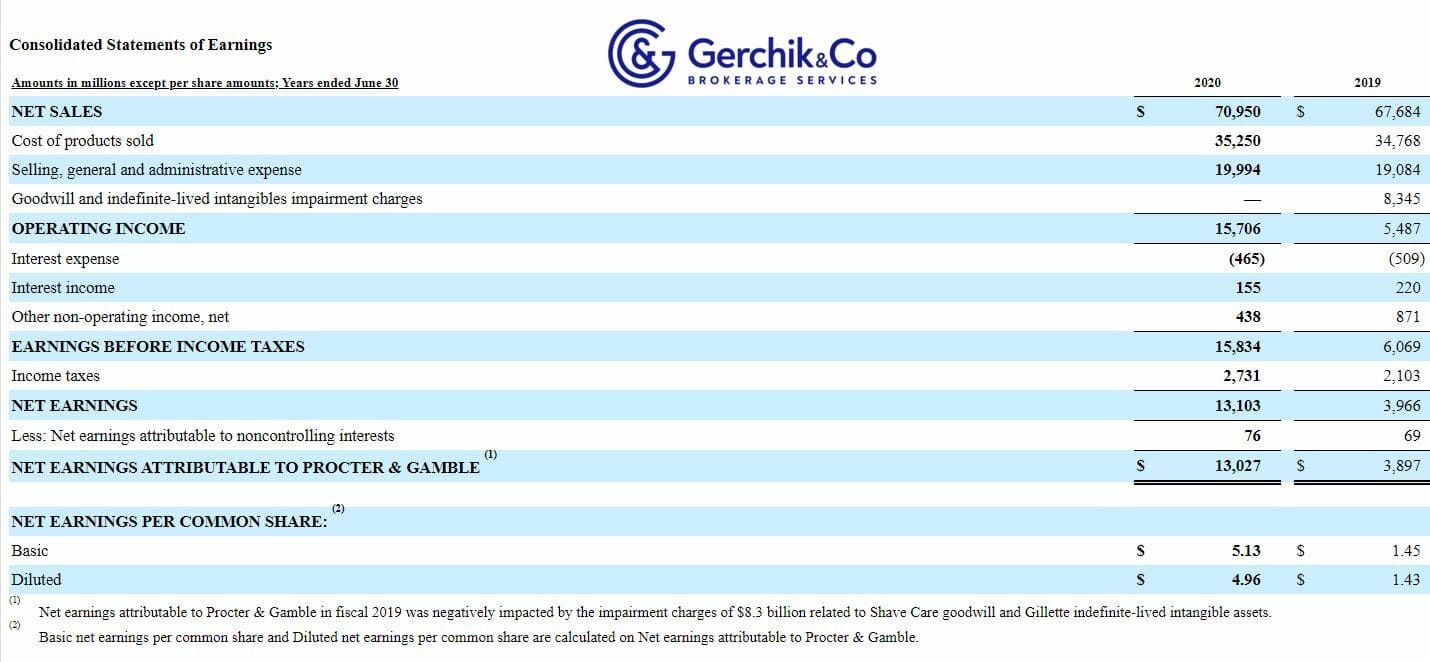

1. P&G Operating Profit Margin for the financial year ended June 2020:

Operating Profit Margin = Operating Income/ Net Sales × 100 = $15,706 / $70,950 × 100 = 22.14%

2. P&G Operating Profit Margin for the quarter ended September 2020:

Operating Profit Margin = Operating Income/ Net Sales × 100 = $5,281 / $19,318 × 100 = 27.34%

3. Procter & Gamble Operating Profit Margin is expanding. This is a good sign. With this indicator, P&G ranks among the top companies, outperforming many peers in the consumer goods industry. The industry average value is 4.83.

4. Over time, P&G Operating Profit Margin has gradually grown since mid-2019. Since March 2020, this value has doubled. For the quarter ended March 2020, it amounts to 10%.

Operating Profit Margin is an important screening filter. This ratio must either be consistent or expandable.

A steady decrease in margins may show that a company has major problems. By controlling this marker, any investor can assess the prospects in advance and avoid financial losses.

⇐ Key to making money with shares. Lesson 13. Gross Margin. P&G Key to making money with shares. How to pick stocks ⇒