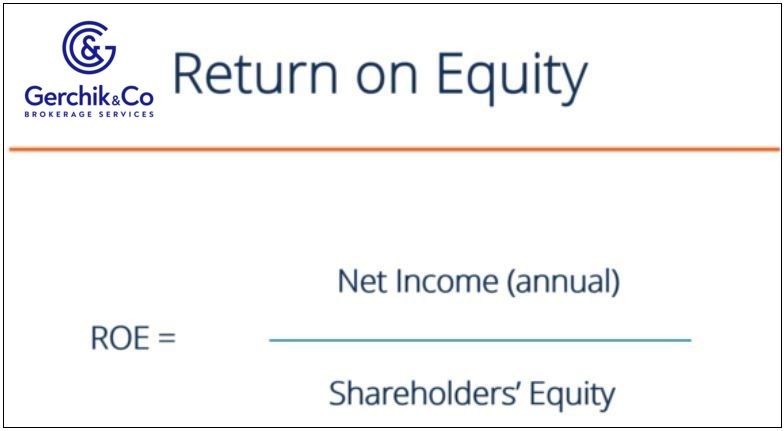

Return on Equity or ROE is a metric of financial performance calculated as net income divided by the value of its total shareholders’ equity and expressed as a percentage.

This indicator is crucial for investors since it helps to gain an insight into how well the invested shareholders’ equity has been used and whether the assets actually generate proper returns. ROE reflects the efficiency of using the portion of equity––or assets––that belongs to the company owners.

ROE has two key components:

1. It compares the figures of the income statement, and

2. losses to the net income relative to shareholders’ equity.

In other words, it measures how much profit is made for each dollar of shareholders’ equity.

ROE = Net Income / Shareholders’ Equity

ROE provides a simple and straightforward metric for the evaluation of returns. By comparing the company's ROE to the industry-average figures, you can get an idea of your competitive advantage. On top of that, ROE allows seeing whether the shareholders’ equity is used well by the company's management team in order to grow the business.

A stable and steadily increasing return on equity means that the company is creating solid shareholder value. It knows how to reinvest its profits efficiently and boost performance. In contrast, when ROE figures are declining, this may imply that the company is adopting poor decisions as far as capital reinvestment goes.

ROE helps investors understand the return they get by investing in a particular company. The company, in turn, applies this metric to evaluate the efficiency of the shareholders’ equity usage. To be able to meet the needs of investors, the company needs to put its best foot forward to achieve a higher ROE.

ROE alone does not mean much unless you analyze it along with historical data and industry-average figures. In order to get a clear picture of the company’s performance and ensure proper evaluation, we need to use other multiples. E.g. Cyclical industries tend to generate bigger ROE.

In addition, it is recommended to compare the company's return on equity to its shareholders’ equity. If the return on equity exceeds the cost of equity, it means that the company has added value. The stocks of a company with an ROE of 20% will typically be worth twice as much as the stocks of the company with an ROE of 10% under otherwise equal conditions.

Let’s use several methods to calculate its ROE for the quarter ended in September 2020

1. Net income for trailing twelve months (TTM) for the quarter ended in September 2020.

Net Income (Sep 2020) = $1,171 (Dec 19) − $699 (Mar 20) + $122 (Jun 20) + $801(Sep 20) = $1,395

2. There are several ways to calculate shareholders’ equity or you can take a simpler route and look it up in the relevant item on the balance sheet.

Total Shareholders’ Equity = Total Assets − Total Liabilities = $22,145 − $17,232 = $4,913

3. Let’s calculate Booking’s ROE for the quarter ended in September 2020.

ROE = Net income / Total Shareholder’s Equity = 1,395 / 4,913 = 0.2839 = 28.39%

4. Drivers of ROE. The ROE formula here is net income divided by shareholders’ equity. However, we can break it down into additional components. By taking a look at the figure below, you will see that the ROE calculation formula consists of the return on assets (ROA) and the leverage.

Let’s take a closer look at it.

Net Income / Equity = (Net Income / Total Assets) * (Total Assets / Equity) = (1,395 / 22,145) * (22,145 / 4,913) = 0.2839 = 28.39%

5. DuPont Formula

DuPont formula breaks down ROE into three main components. Each one can come in handy when examining the company’s returns. Basically, ROE is equal to the net income multiplied by total assets multiplied by the leverage.

An increase in the net profit margin implies that the company is managing its operating and financial expenses really well, which, in turn, will drive up ROE. The growing asset turnover means that the shareholders’ equity is being used efficiently. In other words, the company generates more sales for each dollar of owned assets. When there is an increase in financial leverage, the company can use borrowed funds to boost profits.

To illustrate this, we are going to apply the DuPont 3-step method.

To do this, we shall take the figures of the last twelve months revenues (TTM) for the period ended in September 2020

(see here)

Net Sales = $3,339 (Dec 2019) + $2,228 (Mar 2020) + $630 (Jun 2020) + $2,640 (Sep 2020) = $8,897

ROE = (Net Income / Net Sales) * (Net Sales / Total Assets) * (Total Assets / Equity) = ($1,395 / $8,897) * ($8,897 / $22,145) * ($22,145 / $4,913) = 28.39%

It stands to mention that there are certain challenges associated with DuPont analysis:

1. Too many figures involved. Just one mistake in calculation can lead to inaccurate interpretation. Plus, the information source has to be very reliable.

2. Seasonal factors must be taken into consideration when performing DuPont analysis. In most cases, this can be quite problematic.

6. We have been witnessing a gradual decline in Booking Holding’s return on equity since the end of 2019, i.e. each dollar of shareholders’ equity generated $0.28 in net profit as compared to $0.80 at the end of 2019.

7. As compared to competitors, Booking Holding’s ROE obviously takes the upper hand. The highest ROE over the course of the last 13 years was 66% with the lowest being 22%. The median figure is 34%.

ROE is a go-to indicator for any shareholder and investor as it helps to understand the returns their capital is generating. With that said, if you wish to learn what is behind ROE, you have to apply the DuPont equation. That way you will be able to identify the actual culprit and find out how the business addressed it.

Based on DuPont analysis, we compare three separate ratios in order to establish whether it makes sense to invest in a particular company.

⇐ Key to making money with shares. Lesson 9. ROA. Facebook Key to making money with shares. Lesson 11. ROI ⇒