- EBITDA is a multiple that gives a snapshot of business operations. EBITDA shows how much cash a company generates and whether it can be used in a discretionary way given the business area.

- EBITDA focuses on operating factors. Profitability from core operations even before the effects of leverage, capital structure, and non-cash items, such as amortization, are factored in.

- EBITDA less depreciation/amortization (DA) equals operating income (EBIT). In other words, EBITDA is a change in operating income that doesn’t take into account non-operating and certain non-cash expenses. It’s all about eliminating factors (at the discretion of business owners), e.g., capital structure, debt obligations, amortization methods, or taxes (in a way). All in all, we get the company’s financial data without the above items.

- EBITDA can play a misleading role for investors, as this multiple subtracts the cost of capital investments, such as property, plant, and equipment. Also, it eliminates expenses related to financial liabilities by using a reverse charge on income tax and interest.

Create a personal account and get 10 materials for profitable trading

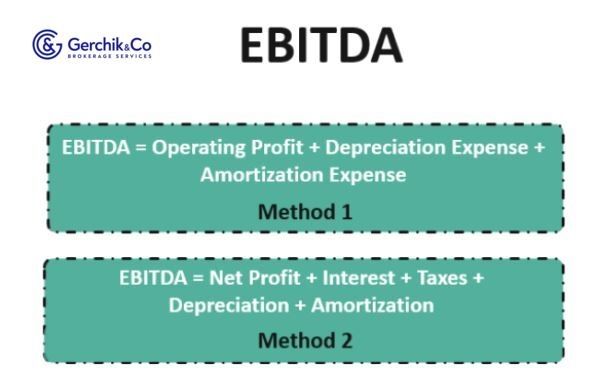

Formula

Method 1

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Method 2

EBITDA = Operating Profit + Depreciation + Amortization

Real-world case. #CMCSA

1.Method 1 — #СМСSA EBITDA for the financial year ended in December 2020 totals:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization = $10,534+$167+ ($4,588 − $1,160) + $3,364 + ($8,320 + $4,780) = $30,593

.jpg)

2. Method 2 — #СМСSA EBITDA for the financial year ended in December 2020 totals

EBITDA = Operating Profit + Depreciation + Amortization = $17,493 + ($8,320 + $4,780) = $30,593

.jpg)

3. Adjusted #CMCSA EBITDA = $30,593 + $233 = $30,826

.jpg)

In 2002, SEC US paid attention to non-GAAP metrics used thereby establishing the exact definition for both EBITDA and EBIT.

.jpg)

Companies shifting away from the basic formula, i.e., those that “cleanse” the figure from other costs, except for interest, tax, and amortization, and make adjustments, usually add the word “Adjusted.”

Our example illustrates the adjustment factor in the note to the statements: operating and administrative costs ($56 + $177).

.jpg)

4. From a dynamic perspective, we have been witnessing a gradual decline in #CMCSA EBITDA since 2019.

- 2018 — +7.14 %;

- 2019 — +14.8 %;

- 2020 — −10.2 %.

5. For illustrative purposes, let’s take a closer look at the annual EBITDA dynamics of the peer companies:

- Netflix #NFLX (Market Cap totaling $231.66B) + 30.06%

- Сomcast Corp. #CMCSA (Market Cap totaling $260.59B) −10.23%

- Walt Disney Co #DIS (Market Cap totaling $357.15B) − 60.29%

.jpg)

Standard

- Relatively high EBITDA is better.

- Data vary by scale and industry.

- The best olition for finding “normal” EBITDA is lieer comparisons and comparisons over time.

Let’s say in terms of depreciation/amortization. You have to upgrade tangible assets over time. EBITDA for a media company is largely discretionary. Issuers are free to use (or not) most of the EBITDA generated by a company. In contrast, EBITDA for a manufacturer is largely not discretionary. Issuers will use most of EBITDA to replace hard assets; otherwise, a company will literally collapse over time.

You can come across EBITDA in the following formulas (see next lessons):

- EBITDA Margin;

- EV / EBITDA;

- Net Debt / EBITDA;

- EBITDA / Interest Expenses.

Open an account and start trading top CFDs

Amortization + Depreciation

- EBITDA is extensively used in financial analysis, as depreciation and amortization aren’t current cash costs. Depreciation and amortization are the allocations of costs to assets over the time they are profitable. Current depreciation and amortization costs are about assets acquired in the past. Consumable assets may or may not need replacement in the future. In this case, the cost of replacing assets may be more or less than in the past. For that reason, depreciation and amortization costs a company accounts for in the current year may not be related to the actual cash costs to maintain its assets in the future.

- Company’s amortization costs depend on both the expectations for the assets it owns and the choice of accounting methods. Two companies with identical assets may have different amortization costs because they have different expectations for their useful lives and different accounting methods.

- Analysts use EBITDA when they wish to remove personal choices from the company’s books. It’s a kind of attempt to make the performance of different companies more comparable, i.e., to lay the same foundation.

Limitations

- EBITDA isn’t recognized by IFRS or US GAAli. In fact, some investors, such as Warren Buffett and Charlie Munger, show disdain for EBITDA because it doesn’t factor in a company’s asset amortization. E.g. If an issuer has lots of equipment—and, consequently, high amortization charges—then the costs of maintaining these assets aren’t recognized.

- Let’s say a fast-growing manufacturing company may show annual increases in sales and EBITDA but acquired a lot of fixed assets to promote growth through debt financing. Initially, an investor may see an income boost, but one should be objective and assess other indicators as well, e.g., CAPEX, net income, etc.

- It doesn’t take into account the cost of working capital and assets.

- It makes an opinion about an issuer less objective.

- By determining operating profit differently and including/excluding income from non-core activities, you can get dramatically different figures.

- By focusing on EBITDA rather than net income, a company can divert attention from its problems in the books.

- Investors should be careful if financial statements show EBITDA, i.e., they didn’t previously include this indicator. A company may be using heavy loans or increasing capital expenditures. In this case, EBITDA can distract investors from important changes.

Let’s sum things up

1. What matters is the type of activity and operating performance. With EBITDA, you can assess an issuer’s profit regardless of the following metrics:

- debt obligations;

- amount of investments;

- tax regime.

2. EBITDA is most handy when you compare several issuers within the same industry and with similar services or range of products.

3. When used separately, EBITDA isn’t the most reliable metric for assessing operating profitability.

⇐ Key to making money with shares. Lesson 22. Equity Multiplier Ratio. Newmont corporation Key to making money with shares. How to pick stocks ⇒

Useful articles:

Login in Personal Account