Every person has at least once been puzzled by the question, “What is GDP?” This figure is one of the crucial indicators of both the global economy, and the economy of each country.

Based on the GDP growth rates, we can determine whether the economy is developing or stagnating, while the traders can even make money on it.

1. GDP: What is it and how to measure it

2. Change in GDP and what it means

3. Causes of increase and decline in GDP

4. How to make money on GDP

GDP stands for gross domestic product. It is a total monetary or market value of all goods and services produced in the country in a specific time period.

There are two types of GDP: nominal gross domestic product and real gross domestic product.

1. Nominal GDP is calculated using the current prices. Not only a change in the real output of goods and services, but also price level changes have an impact on it.

2. Real GDP is an inflation-adjusted indicator expressed in base-year prices. The economists can choose the base year as they deem fit. To calculate the real gross domestic product, we have to divide the nominal GDP over a GDP deflator.

Now let's consider the importance of this indicator. Every country produces goods and services both for domestic consumption and for export. If their figures are rising, it means the economy is developing. If, for some reason, there is a decline in production of goods and services, it points to an economic slowdown.

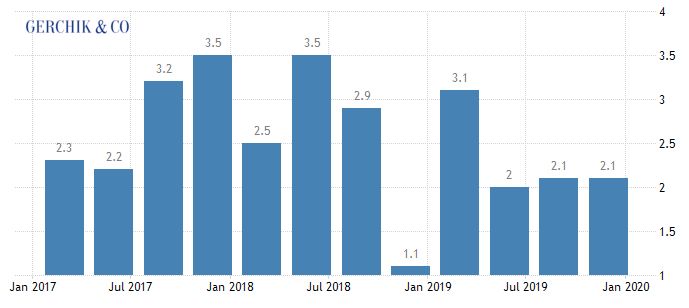

Typically, economists measure the GDP growth rate i.e. the percentage by which the indicator has increased over a specific time period (month, quarter, year). On the chart below, you can see the United States GDP growth rate.

When GDP growth rates are increasing by less than 2-3% for several years, this is a sign of recession. A sharp decline in GDP means that an economic crisis is about to begin.

Based on the GDP growth dynamics, two states of the economy - stagnation and depression - can be singled out. Stagnation takes place when gross domestic product is barely growing, yet there is no dramatic decline. When there is a dramatic drop in GDP figures for several years, this is called an economic depression and implies a protracted crisis.

Answering the question, “What is GDP?”, we established that it is a total value of all goods and services produced in the country. In the stable economy, people have jobs and money; there is a growing demand for goods and services. Increase in demand leads to an increase in supply. Consequently, production grows, and so does the GDP.

However, production can stop or slow down for a number of reasons, one of which is a drop in demand. With increasing unemployment rate in the country, the population becomes insolvent, thus cutting back on purchases and expenses. This, in turn, leads to a drop in demand. According to the laws of the market-oriented economy, businesses and enterprises start reducing production.

Suspension of operation of small and medium-sized businesses, as well as a number of big companies is the second reason the world didn’t expect in 2020. Due to the coronavirus pandemic and lockdowns around the globe, people obviously cannot generate GDP while self-isolating at home.

NOTE!

GDP growth rates highly depend on the inflation rate and the state of the labor market.

With a reduction in unemployment and an increase in employment, GDP grows in the country, as a solvent population increases the demand for goods and services, automatically stimulating the growth of supply. In case of high inflation, nominal gross domestic product increases too.

We established that real GDP is calculated using the prices of the chosen base year. Therefore, real economic growth rates can be significantly lower.

Changes in GDP growth rates affect the exchange rate of the national currency. This is the reason why traders who trade in the financial markets can make money using this indicator.

It is known that the higher the economic growth-rate growth, the stronger the currency, and vice versa. The acceleration of GDP growth is what has the biggest impact on the exchange rate. Knowing what GDP is and how it is connected to other economic indicators, you can predict the exchange rate movement direction.

Understanding what GDP is and how critically important it is when it comes to assessment of economic situation, the central bank can change its monetary policy based on its value. If economic growth slows down, the central bank may lower the interest rate or even implement a quantitative easing (QE) program. This will allow reducing the cost of loans, which, in turn, should spur development. That said, such measures will make national currency weaker.

By keeping track of the economic growth rates, the trader can understand the GDP dynamics and whether it will lead to lower rates and a drop in foreign currency. If this is the case, it would make sense to go short. On the flip side, changes in GDP growth rates may affect the currency exchange rate when statistical data are released.

By checking out the economic calendar, you can learn the schedule of release dates of GDP statistics by country. It typically demonstrates the previous value, forecast and the actual current value. If the actual value exceeds the forecasted one, the currency may increase. If it is lower, it may drop. The traders take advantage of these situations to make a speculative profit by trading news.

Understanding the essence of GDP and being able to track down its change in the economic calendar, you now know how to make money on it. However, GDP is a lagging indicator, which means that is often released two months after the end of the reporting period.

To calculate whether the economic growth rates will be higher or lower than the figures of the previous period, you can also keep an eye on the data of other indicators that real GDP depends on. This can be statistics on retail sales, durable goods orders, business activity indices in the services and production sectors.

When the figures demonstrate positive dynamics, we can expect a solid increase in GDP. This, in turn, evidences the economic strengthening and drives up the value of the currency. At the same time, traders get the chance to make profit by buying it.

Protect yourself against the trading risks

using Risk Manager brought to you by Gerchik & Co!

Learn more about the service