Debt to Capital is a liquidity ratio that measures a company’s financial leverage by comparing total liabilities with the total capital. To put it another way, it measures the portion of debts a company uses to finance its operations compared to its total capital.

Consequently, companies that have higher ratios are considered to be riskier because they must keep their sales at the same level to meet their debt service obligations. Slumping sales may cause a company certain solvency problems.

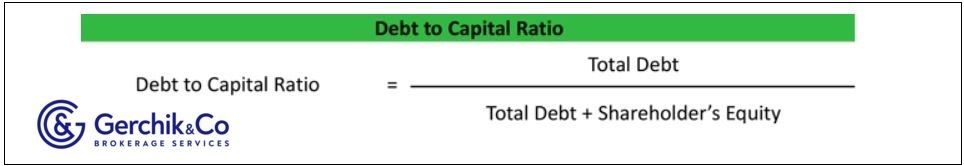

To calculate Debt to Capital, you need to divide the company’s total debt by the amount of equity and total debt.

1. Debt to Capital helps find out whether a company is dependent on debt to finance its day-to-day operations and assess risks for the company’s shareholders. Also, it measures a company’s creditworthiness to meet its obligations, i.e., interest expenses and other payments.

2. Traditionally, the larger the ratio, the higher the risk for creditors and shareholders. But it’s not always the case. Like any other financial metric, you can’t analyze it if you have insufficient information. A high ratio isn’t always a bad thing.

For instance, companies may have high debt levels, as their operations are capital intensive. This makes Debt to Capital higher but doesn’t mean that they’ll soon become insolvent. If they have an extremely stable customer base, they can meet their obligations without worrying about any drops in profits.

3. Let’s compare this case with new and growing companies. Maybe they don’t have a solid customer base, but they still have to finance their day-to-day operations. They may have stable sales, but this is no guarantee of their solvency. Ultimately, the sales of a new company may drop, leaving fewer funds for debt servicing. In this case, a high Debt to Capital ratio would indicate a risk.

4. If Debt to Capital is greater than 1 (>1), this means that debt exceeds equity, which is an obvious warning sign pointing to financial weakness. Increasing debts without increasing profits raises a bankruptcy risk.

5. If Debt to Capital is less than 1 (<1), this means that the debt level is controlled, while a company is considered to be less risky in terms of investing or lending, given other factors.

1. Let’s calculate the total debt for the quarter ended in September 2020:

Total debt = (Short-Term Debt + Fixed Payment Obligations) + (Long-Term Debt + Fixed Payment Obligations) = ($551 + $100) + ($547 + $5,479) = $651 + $6,026 = $6,677

2. Total Capital for the quarter ended in September 2020:

Total Capital = Total Stockholders’ Equity + Total Debt = $22,661 + $6,677 = $29,338

3. Now let’s measure Debt to Capital for the quarter ended in September 2020:

Debt to Capital = Total Debt / Total Capital = $6,677 / $29,338 * 100 = 22.76%

So, the leverage for each dollar in NEM’s Total Capital is 23 cents.

4. Here are the figures shown dynamically: since 2015 (38%), #NEM’s Debt to Capital has been decreasing. Since the beginning of 2019 (29%), the ratio has decreased by 20 percentage points.

The level of Debt to Capital for the quarter ended in September 2020 was minimal.

5. When compared to a peer with a similar capitalization (Barrick Gold Corp #GOLD 20.53%), we can see that companies within the same industry demonstrate a low and almost the same level of Debt to Capital.

Open an account and start trading CFDs on top stocks

LTdebt/Capital is pretty similar to Debt/Capital. Long-term debt means an interest-bearing liability for more than 12 months from the date on which it was put in the balance sheet.

The long-term debt to capitalization ratio demonstrates how long-term interest-bearing debt, e.g., bonds and mortgages, is used to continuously finance a company. This helps investors find out a company’s control level and compare it with its peers to analyze an overall risk experience.

LTdebt/Capital NEM = $6,026 / $29,338 * 100 = 20.54%

The last three lessons (19, 20, and 21) have helped us learn three solvency ratios known as leverage ratios, using the example of Newmont Corporation. Let’s look at the big picture from a three-year perspective:

Over the three-year period, we clearly see the debt load decreasing since the beginning of 2019. Efficient management allows borrowing less in terms of key balance sheet indicators (equity, assets, and total capital).

From the standpoint of debts, Newmont Corporation looks definitely less risky and much more promising. The company is robust, doesn’t face any major financial problems, and controls the debt load.

⇐ Key to making money with shares. Lesson 20. Debt to Asset Key to making money with shares. How to pick stocks ⇒