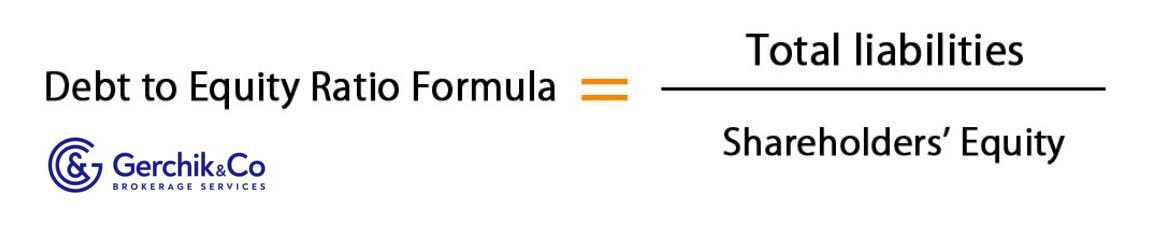

The debt-to-equity (D/E) ratio, also known as the debt-equity ratio, risk ratio, or gearing, is used to evaluate financial leverage and calculated by dividing total financial liabilities by shareholders’ equity. Unlike the total-debt-to-total-assets ratio, where assets are used as the denominator, we use shareholders’ equity to measure the D/E ratio.

This ratio shows whether a company finances its operations through debt or using internal resources. When you make an investment decision, you must understand what approach a company uses.

.jpg)

Essentially, the D/E ratio is about comparing “external” and “internal” finances.

Use the balance sheet item “Total Debt” as the numerator and “Equity” as the denominator. If preferred shares are included in the equity, you need to factor them in the calculation as well.

Total debt is the sum of short-term and long-term debt. Also, other liabilities for the company’s fixed payments that arise during its operations may be factored in.

Shareholders’ equity is shareholders’ residual interest that’s calculated as the difference between assets and liabilities.

1. Let’s measure the total debt for the quarter ended in September 2020:

Total Debt = (Short-Term Debt + Fixed Payment Obligations) + (Long-Term Debt + Fixed Payment Obligations) = ($551 + $100) + ($547 + $5,479) = $651 + $6,026 = $6,677

2. Shareholders’ equity for the quarter ended in September 2020 totals $22,661

3. Let’s establish the D/E for the quarter ended in September 2020:

D/E = Total Debt / Shareholders’ Equity = $6,677 / $22,661 * 100 = 29.46%

Here’s the case: NEM has 29 cents of leverage for every dollar of equity.

4. Over time, #NEM’s D/E ratio has been steadily decreasing. Since 2014, the D/E ratio of 0.51 has been triggering a gradual decline, which means that the share of external financing is shrinking.

5. Compared to industry peers, #NEM has a decent D/E ratio. If we compare this ratio with that of a similar company — Barrick Gold Corp., #GOLD D/E 0.23 —, we see that these companies have fairly equal and low debt-to-equity levels.

Note:

You can often come across the long-term debt to equity ratio. In general, it’s similar to the D/E ratio; the only difference is that it factors in long-term liabilities. Simply put, it’s a leverage ratio comparing long-term debt against shareholders’ equity.

1. The D/E ratio is a key metric to analyze solvency. If you want to assess a company’s solvency, the D/E ratio should be the first metric for you to use in your analysis module. With the D/E ratio, you—as an investor—will not only understand a company’s financial standing but also its long-term prospects.

2. For example, if a company uses some insignificant external financing or doesn’t use it at all, then it’s most likely trying to operate using its equity. Consequently, it’s unlikely that such a company will borrow any funds.

3. If a company’s debt significantly exceeds its equity, creditors’ interest is larger than shareholders’ one.

⇐ Key to making money with stocks. Lesson 18. Net Interest Margin. JP Morgan Key to making money with shares. How to pick stocks ⇒