We keep unlocking the secrets of financial ratios that help both traders and investors understand how to invest profitably. In this article, we shall focus on return on investment (ROI).

Definition

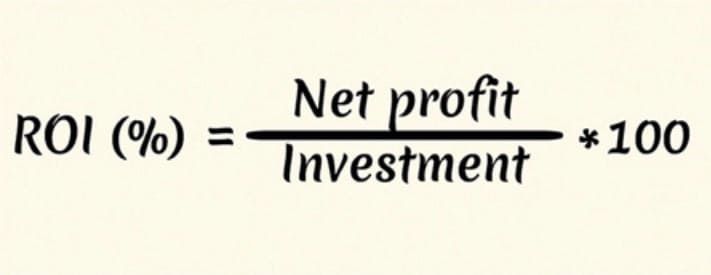

The multiple Return on Investment is a metric calculated by dividing your net profit (or loss) by your initial outlay.

ROI—also known as ROR (Rate of Return)—belongs to cross-profit margins. In simple terms, it’s a ratio between the company’s net income and investments.

Capital is an expensive resource which is why your company should invest in the project that can make sure you have sufficient income to cover your costs.

.jpg)

Components of ROI calculation formula

Traditionally, we take the net income for the last twelve months (trailing twelve months or TTM) in the profit and loss statement. Investment is a multipurpose term, as it has different interpretations in different contexts.

We typically use current assets and long-term liabilities (see the balance sheet) to evaluate how well our funds have performed.

Types of ROI

- Pre-Tax Tax ROI.

- After-Tax ROI (more common).

Standard ROI

- ROI that’s higher than average returns for specific assets is considered to be highly profitable.

- The higher the company’s ROI, the better it performs.

- The larger the company, the more segments need to be evaluated. Based on the results, we get the weighted average ROI.

- If your portfolio includes some shares of a company with ROI being 15–20% per annum for a long time, this can be considered a good investment in terms of profitability.

.jpg)

The example illustrated by Costco

Your returns can be measured in a variety of ways. For calculation purposes, we’ll use the formula for the mega-retailer Costco (#COST).

1. Net Income for the quarter ended in August 2020

Since we are using the trailing twelve months (TTM), we need the last 4 quarters. TTM (trailing twelve months) net income for the period ended in August 2020 totals:

(1).jpg)

$844 (Nov 2019) + $931 (Feb 2020) + $838 (May 2020) + $1,389 (Aug 2020) = $4,002

2. Let’s calculate the invested capital

(1).jpg)

Investments = Long-Term Debt (excluding current portion) + Equity = $7,514 + $18,705 = $26,219

3. ROI = 4,002 / 26,219 * 100% = 15.26%

(1).jpg)

4. Costco’s ROI is growing in real-time, i.e. the share of profits for each dollar of investments is increasing. ROI totaled 18% a year ago.

(1).jpg)

5. As compared to similar companies operating in the consumer sector, COST has a solid stable ROI.

(1).jpg)

ROI drawbacks

- ROI does not factor in the passage of time. Any business investment project is “mothballed” until it starts making a profit. Investors should look into generating income from one project earlier to have some resources for future investments.

- This is based on accounting income that depends on various accounting rules, e.g., IFRS and GAAP.

- If the net income and ROI change explicitly, this may indicate accounting manipulations. In this regard, profitability indicators preferably need to be averaged and used if the investment horizon lasts longer than several years.

- ROI is a relative metric and therefore doesn’t factor in the amount of investment.

- The time value of money isn’t factored in.

- ROI reflects the past period and doesn’t predict the future one.

ROI advantages

- Perfect for various forms of evaluation.

- Generally accepted formulas and calculations in percentage terms.

- Simple and straightforward calculations.

- Suitable for any ROI (entire business or specific segments).

- Useful for benchmarking.

- Covering the project’s entire duration.

- If you invest with long-term profits in mind, ROI will help you evaluate how well your future investments are going to perform.

- If you focus on receiving stock dividends and profits on their sales, ROI will compare the ratios of different companies. This helps you build an investment portfolio that’s immune to market fluctuations.

Let’s sum it up

ROI primarily aims to show how well the company manages long-term investments, what returns it gets, and whether its growth is gradual.

The company invests in the project using the funds from various debt providers (equity participation), which obliges it to pay the interests and dividends on investments. Therefore, the company should at least receive some income to make timely payments to the corresponding parties.

As an investor, you should evaluate the project’s various elements to see how efficiently your capital investments have performed. If you have only one group of profitability indicators, you may shape some misconceptions about the project from the perspective of other stakeholders.

⇐ Key to making money with shares. Lesson 10. Return on equity (ROE) Key to making money with shares. How to pick stocks ⇒

Useful articles:

Login in Personal Account