A trading balance is one of the essential indicators for everyone who decided to make money on the financial markets. Success in stock exchange trading or investing is measured by how quickly this balance increases. Its growth is what every market player aims to achieve.

In this article, we are going to discuss how to preserve and increase your funds through smart trading.

1. How Trading Balance Gets Formed

2. Trading Balance: Where to Begin

3. How to Increase Trading Balance

The trading balance is the amount of money available in a trading account. The upfront balance is the initial sum of money you deposit to start earning in the financial markets. As you trade, this amount changes due to profit or loss added to it.

In order for the balance amount to grow rather than decrease, you need to follow certain rules which we will describe below.

How much money do you need to start trading in financial markets? This is the first question all newbies ask. And we are going to try to answer it as objectively as possible.

Theoretically speaking, the bigger the upfront capital, the better. And here's why. The bigger the sum of money, the more lots you can trade. In turn, this means that the profit per position increases in multiples of the number of lots.

Aside from that, a large deposit has another great advantage: the larger the amount in the trading account, the smaller the risks. Each brokerage company has its own minimum deposit amount. You will be able to not only keep the risk per trade to a minimum but also use diversification and hedging strategies which increase both the chances of making winning trades and the amount in the trading balance.

Naturally, novice traders may have drastically different financial means. This is why, by asking the question about the trading balance, they typically mean the minimum allowable amount for opening a trading deposit. However, it is better to calculate this amount based on risk management which we shall discuss below.

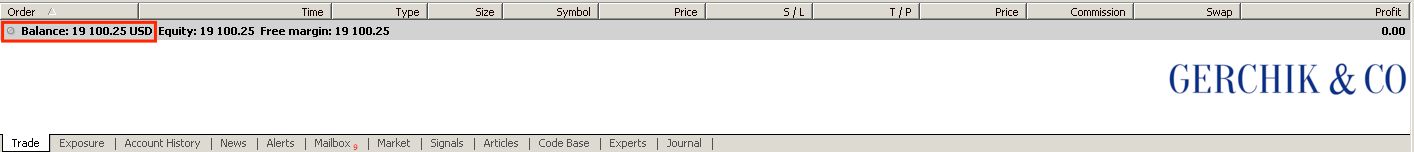

After replenishing your trading account, click on the “Trade” tab, the “Terminal” table in the MetaTrader 4 platform to see the balance.

Once you have opened a trading account and started trading in the financial markets, the balance of your account will depend solely on your trading performance. It all may seem simple on the surface - just make winning deals, grow the amount in the account and you are good.

That being said, the reality is quite different. The trader who makes only profitable trades simply doesn’t exist. But there’s a solution that helps traders to mitigate risks and preserve their profits. This is money and risk management.

Everyone who wishes to earn consistently on the stock exchange needs to master the art of money and risk management. Experienced traders have worked out several rules by following which you can increase your trading balance.

As mentioned previously, every trader makes both winning and losing trades. The one, whose overall result on winning trades exceeds the overall result on losing ones, can be considered a successful trader.

The novice traders often get disheartened when they see how the price goes against them and incur loss on their trading position. However, this is a natural part of trading life.

First of all, anything can happen on the market at any time. The price may go in the opposite direction even when your forecast was accurate. Second of all, there is no way you can be right all the time. Your entry point could be inaccurate. Third of all, even with the best trading strategy, you will still have a certain portion of losing trades.

That’s why, the trader’s task is not to avoid losing trades but to make the outcome of winning trades exceed the losing ones, since the trading balance is the amount of your initial deposit, plus the trading result. To achieve this, you need to learn how to close unprofitable positions in a timely manner, using stop-loss order.

To help your trading balance grow, you cannot do without a trading strategy that will prove to be profitable. You won’t be able to achieve an increase in the trading balance by trading chaotically.

How to pick a trading strategy, and is there one that works best? There are plenty of strategies to choose from with many new ones emerging daily. When deciding on a strategy, use the following criteria:

It doesn’t matter whether it is based on indicators, technical levels, Price Action patterns or all of the above as long as you understand how to identify a trading signal.

Depending on your work pattern and personality, you can choose both scalping and intraday strategies, as well as build relevant trading portfolios suitable for the medium-term and long-term trading. Your strategy needs to generate profit on winning trades that exceeds the amount of money lost in unprofitable ones.

The ability to manage risks properly is the key to the positive trading balance. Pay attention to the following aspects:

1. The risk/reward ratio per trade. Typically, it should be no less than 1:2, 1:3 on average or ideally, even higher. Even if your trading strategy produces 50% of winning trades and 50% of losing ones, your trading balance will still be growing.

2. Calculate the volume of a position accurately. It is best to start from the risk. Check the size of the stop loss that is in line with your trading strategy. In the deposit currency, it should be about 1% of the total amount in the account on average.

That said, this figure depends on the trading strategy. Based on it, you need to calculate the volume you are planning to enter with.

It's no secret that 80% of trading success depends on the trader’s mindset. Certain emotions can act as our biggest enemies, forcing us to bounce back after a bad trade or impulsively open a new position after a successful one.

To protect the trading balance against the impact of emotions and eliminate the human factor, simply connect Risk Manager to your trading account. This solution won’t let you violate your own rules when emotions take over you. Your deposit will be safe, while the sum of money on your trading balance will grow consistently.