In Lesson 30, we got to the bottom of the current ratio, a valuation metric that’s widely used in market analysis. However, if the company is experiencing a lack of liquidity, the lenders typically pay closer attention to the quick ratio. This is a more advanced version of the liquidity test.

The quick ratio also known as the acid-test ratio measures the company’s ability to pay its short-term liabilities using assets that are readily convertible into cash, i.e. the most liquid assets. These include cash, accounts receivable, and marketable securities that are also referred to as “quick assets” since they can be easily converted into cash without a reduction in value.

Unlike the current ratio, the quick ratio is considered a more conservative metric as it excludes inventories from current assets. It was supposedly named this way because these assets serve as a quick source of money. Typically, it takes time to turn inventories into money. In cases where they need to be sold quickly, the company might have to settle for a lower price than the book value of those inventories. Hence, they are justifiably excluded from the assets that act as a readily available cash source.

Since the quick ratio enables us to measure whether the company is capable of paying its current liabilities in the short run, it is seen as one of the most critical liquidity indicators.

✅ Average interest rate on deposits per annum — 10 %

✅Trader’s average annual profitability — 50-100 %

Open an account and make more money than in the bank!

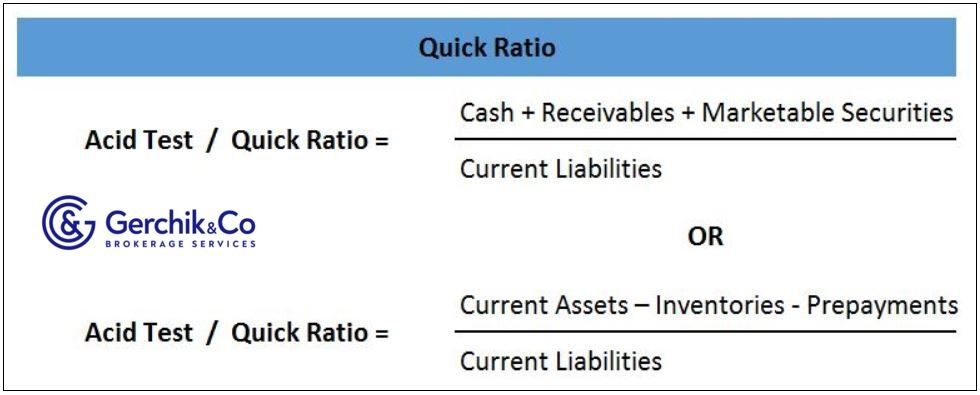

Acid Test / Quick Ratio = (Cash and Cash Equivalent + Short-Term Accounts Receivable + Short-Term Investments) / Current Liabilities

Acid Test / Quick Ratio = (Current Assets − Inventories − Prepayments) / Current Liabilities

If you were able to calculate the current ratio, finding out the value of the quick ratio won’t be a problem. The formula uses all current assets, except for:

1. Using formula 1, we will now calculate the ratio for the quarter ended in March 2021.

Quick Ratio = (Cash and Cash Equivalent + Short-term Accounts Receivable + Short-Term Investments) / Current Liabilities = ($33,834 + $39,436 + $24,289) / $115,404 = 0.85

2. Using Formula 2, let’s calculate the ratio for the quarter ended in March 2021. See it below.

Quick Ratio = (Current Assets − Inventories) / Current Liabilities = ($121,408 − $23,795) / $115,404 = 0.85

Evidently, both formulas produced the same value: #AMZN quick ratio totals 0.85.

Amazon is currently unable to pay its liabilities to the fullest extent. Its liquid assets do not cover every dollar of short-term loans, i.e. $0.85 for every dollar of liabilities. With that said, judging from the industry average figures, Amazon is not yet in a critical position.

3. Below, we will compare it with the current ratio for the quarter ended in March 2021.

Current Ratio = Current Assets / Current Liabilities = $121,408 / $115,040 = 1.05

The quick ratio cannot exceed the current ratio. This is because the latter reflects total current assets as the numerator divided by current liabilities, whereas the quick ratio excludes inventories from the numerator. Therefore, the first figure will be more insightful than the second one.

Keep in mind that these two ratios will be almost identical, both producing the same results in cases where a company does not have any inventories.

If the debt must be covered in the next 90 days, it makes sense to use the quick ratio. However, if you are examining liquidity from a one-year perspective, it would be a good idea to apply the current ratio that does not omit the inventories.

4. From a dynamic perspective, the quick ratio of #AMZN hasn’t dropped below 0.7 over the past 5 years. However, a decline from 0.97 has been observed since June 2020.

5. #AMZN quick ratio is lower as compared to 53% of companies operating in online retail sector, with industry average being at 0.90.

In broader terms, low or declining quick ratios suggest that a company is overindebted, is struggling to maintain or grow sales, is too quick to pay the bills, or slow in collecting accounts receivable.

In contrast, a high or growing quick liquidity most likely points to the fact that the company is showing a sustained increase in turnover, is rapidly converting accounts receivable into cash and has no problem paying its financial liabilities. This type of companies typically have faster inventory turnover and cash conversion cycles (CCC).

Open an account and start trading CFDs on Amazon stocks

1. It is important to take into account the liquidity factor. Quick ratio and the current ratio can help identify problem areas and see whether the company you're interested in is on the right track.

2. Sufficient figures of this indicator suggest that the company has proper expertise and sound business operation which can result in steady growth.

⇐ How to make money in stocks. Lesson 30. Current ratio. Alibaba Key to making money with shares. How to pick stocks ⇒