The current ratio shows whether a company can pay off its short-term debts that are payable during the year. You can measure the ratio by dividing total current assets by total current liabilities.

The current ratio helps investors and analysts find out whether a company can make the most of its current assets on the balance sheet to pay off current debts and other payables.

Managers, investors, and creditors use the current ratio to analyze financial positions, make corrections and assess whether companies can pay off their debts on time.

Fundamentally, a company’s liquidity is closely connected with its ability to meet obligations to creditors or suppliers. If a company has fewer funds than it needs, there’s a high probability of default. If it has more funds than necessary, their cost will make profits shrink. If we’re talking about liquidity, a balanced position is preferable.

As business operations are different for each sector, it makes sense to always compare companies within the same industry.

✅ Average interest rate on deposits per annum — 10 %

✅ Trader’s average annual profitability — 50-100 %

Open an account and make more money than in the bank!

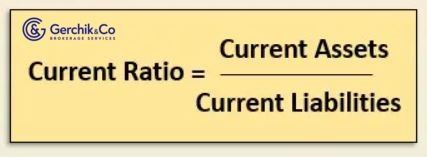

The calculation is pretty straightforward. What we do is basically divide current assets by current liabilities. This figure is typically readily accessible. However, if you still wish to calculate it on your own based on financial statements, here’s a formula you should look into.

Current Ratio = Current Assets / Current Liabilities

Current assets—on the balance sheet—include all those items that are either cash or can be converted into cash in less than a year. Current liabilities—on the balance sheet—are those liabilities that are due for payment during the year. They include payrolls, accounts payable, taxes, short-term loans, and current long-term debts.

1. Let’s calculate the ratio for the quarter ended in December 2020:

Current Ratio = Current Assets / Current Liabilities = $91,606 / $54,890 = 1.67

2. Let’s calculate the ratio for the quarter ended in March 2021:

Current Ratio = Current Assets / Current Liabilities = $98,196 / $57,596 = 1.70

Alibaba Group Holding’s current liquidity ratio is 1.70. #BABA’s current assets are equal to $1.70 for every dollar of current debt. This proves that the company has decent short-term financial stability.

Alibaba Group has more than enough assets to meet current obligations if, let’s say, it has to immediately pay off its debts and covert its current assets into cash.

3. Over the past 5 years, #BABA’s current ratio hasn’t dropped below 1, stably ranging from 1.30 to 1.90).

4. BABA’s current ratio is higher than that of 57% of other companies in the e-commerce industry. The industry average is 1.50.

When it comes to e-commerce companies, the ratio is typically within reasonable limits, as they have adequate reserve funds.

In broad terms, the current ratio of companies with cash sales, quick stock turnovers, and strong positions regarding suppliers may be less than 1. These companies normally don’t have liquidity problems, unless they stop operating or start cutting back.

Open an account and start trading CFDs on top stocks

A truly efficient analysis can only be done within the industry itself and in dynamic terms.

It also makes sense to analyze the structure of the assets and obligations. For instance, the current assets include those that cannot be easily liquidated.

1. Prudential liquidity management is a way to increase profitability thereby making investors richer. A profitable deal with lenders regarding the loan terms and conditions can improve the overall liquidity position and reduce the cost of working capital financing.

2. Companies having a hard time getting receivables paid or having long stock turnovers may face liquidity problems, as they can’t ease their obligations.

3. The current ratio gives an idea of how efficient an operating cycle is. Higher current ratios may speak of an opportunity to invest in undervalued stocks during the financial crisis.

⇐ How to make money in stocks. Lesson 29. EBITDA/Interest coverage. VISA Key to making money with shares. How to pick stocks ⇒