✅ Average interest rate on deposits per annum — 10 %

✅ Trader’s average profitability per annum — 50-100 %

Open an account and earn more money than in a bank!

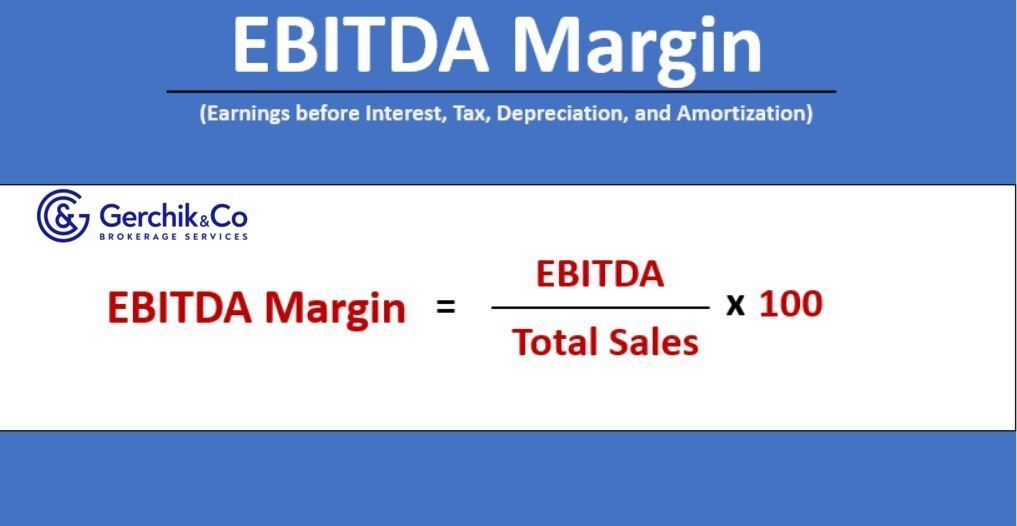

See the definition of the Net Sales in Lesson 24.

We have examined EBITDA closely in Lesson 25.

Now let’s move on to practice.

1. #NFLX EBITDA for financial year ended in December 2020 totals:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization = $2,761.40 + ($767.50 + $618.44) + $437.95 + ($10,806.91 + $115.71) = $15,507.91

2. #NFLX EBITDA Margin for financial year ended in December 2020 totals:

EBITDA Margin = EBITDA / Net Sales = $15,507.91 / 24,996.06 = 62.04%

Netflix’s margin totaling 62% means that 38% of revenues account for operating expenses.

For example, with the 58% margin, the share of such expenses totaled 42% in March 2019.

3. Here is another figure for comparison. EBITDA margin of #CMCSA for the financial year ended in December 2020 totaled:

EBITDA Margin = EBITDA / Net Sales = $30,593 / $103,564 * 100 = 29.54%

By comparing two companies in terms of their margin within a single sector and industry with a similar capitalization, we find out that both companies show excellent performance. #NFLX having an EBITDA margin of 62% is more efficient in cutting operating expenses and maximizing profit. #CMCSA is probably more focused on sales growth. The gap between their EBITDA margins has been widening over the past five years.

4. In terms of #NFLX dynamics, this is what we see:

Open an account and start trading top stock CFDs

1. The EBITDA margin reflects operating profit. This metric minimizes the impact of capital structure and non-monetary items, such as depreciation and amortization. It gives an idea of how much cash a company generates per unit of revenue.

2. The EBITDA margin usually doesn’t take into account company-specific non-core effects. Every company pursues its amortization policy. Besides, capital structures can vary significantly. Eliminating these items helps make a basic comparison between the two companies.

3. The EBITDA margin is an implied alternative to the net profit margin that includes amortization, interest expenses, and taxes. Nevertheless, such expenses don’t affect the EBITDA margin even if tax regimes differ greatly.

4. The EBITDA margin comes in handy when you assess whether the company’s efforts to cut costs are efficient. The higher the EBITDA margin, the lower the company’s operating expenses in terms of revenue.

⇐ How to make money in stocks. Lesson 25. EBITDA. Comcast corp. Key to making money with shares. How to pick stocks ⇒