- EBIT (Earnings Before Interest and Taxes) is an indicator of profitability calculated as the total revenue minus the company’s cost of goods sold and operating expenses. It shows the amount of profit companies receive from their operating activities. The deduction of taxes and interest enables you to step back from capital structure (leverage) and tax rates and thereby allows comparing different companies.

- EBIT is sometimes equated with a close yet slightly different indicator—Operating Income. Obviously, the essence of these indicators is identical (Operating Profit = Earnings Before Interest and Taxes). What makes them different, though, is that EBIT may also include income/expenses not related to operating activities. If there are no other expenses or income, EBIT will be equivalent to Operating Income. In other words, if a company doesn’t have any non-operating income, then Operating Income is used as a synonym for EBIT.

- EBIT is used as some financial multiples in fundamental analysis, e.g., Interest Coverage Ratio (see Lesson 23) or EBIT/EV (we’ll cover that in future lessons).

- Banks often use EBIT as minimum fixed values for the company’s financial indicators to meet the lending criteria.

Calculation Formula

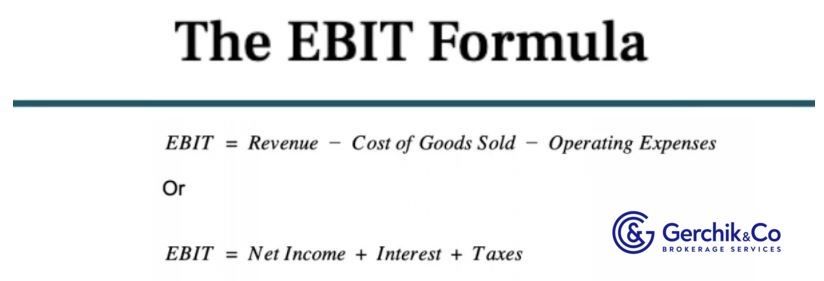

Both direct and indirect methods can be used to calculate EBIT.

Direct Method

Earnings Before Interest and Taxes = Revenue − Cost of Goods Sold − Operating Expenses

Direct method elements:

- Revenue/Total Sales is the company’s key source of income generated from the sale of goods and services in the ordinary course of business.

- Cost of goods sold (COGS) is direct costs for manufacturing finished goods and selling services. This indicator includes the cost of raw materials and supplies, direct labor costs, and other direct overhead costs.

- Operating expenses are costs incurred by a company in the ordinary course of business. These include selling, general and administrative expenses.

Indirect Method

Earnings Before Interest and Tax = Revenues + Interest Expenses + Tax Expenses

Indirect method elements:

- Net income — see Lesson 15

- Interest Expenses — see Lesson 23

- Taxes

- Revenue/Total Sales.

The first EBIT method directly subtracts the expenses from the revenue, while the second equation adds interest and taxes. EBIT “says” that we see earnings before interest and taxes. This difference helps users figure out EBIT from two perspectives.

The first one is to explore EBIT from a preliminary operating perspective.

The second one is to look at profitability for the reporting period. Consequently, you’ll get the same number, but—from an investor’s point of view—it’s important to analyze it using different aspects.

If interest income is the key source of the company’s profit (banks and financial holdings), it acts as an operating income element, and a company will always include it in EBIT.

Real-world case. #NFLX

1. Direct #NFLX EBIT for the financial year ended in December 2020 totals:

Earnings Before Interest and Tax = Revenue − Cost of Goods Sold − Operating Expenses = $24,996.06 − $15,276.32 − ($2,228.36 + $1,829.60 + $1,076.49) = $4,585.29

.jpg)

.jpg)

2. Indirect #NFLX EBIT for the financial year ended in December 2020 totals:

Earnings Before Interest and Tax = Net Income + Interest Expenses + Tax Expenses = $2,761.40 + ($767.50 + $618.44) + $437.95 = $4,585.29

.jpg)

3. In terms of dynamics, we’ve observed a gradual growth of Netflix EBIT since 2017:

.jpg)

- 2018 — + 91.40%;

- 2019 — + 62.24%;

- 2020 — + 76.07%.

We shall not compare EBIT of similar companies. However, for illustrative purposes, let’s take a closer look at the EBIT behavior of entertainment industry peers (please note that the data provided is as of the time of writing):

Netflix #NFLX (Market Cap $231.66 B) +76.07%

Сomcast Corp. #CMCSA (Market Cap $260.59 B) −17.19%

Walt Disney Co #DIS (Market Cap $357.15 B) −145.19%

Standard

- EBIT has no standard values. The more profit, the better. EBIT values need to be compared over time—as a percentage of the company’s net profit and expenses.

- You can sometimes consider the normal minimum positive EBIT. However, it doesn’t guarantee any profit—you may lose money, taking into account your interest (especially with a heavy debt burden).

- You must know the industry standard as a benchmark when comparing any financial metrics of two companies. Comparing EBIT for two companies won’t be enough.

- Besides, you must analyze the annual and quarterly retrospectives when assessing the company’s profit potential.

Open an account and start trading Netflix CFDs

Benefits

- By using EBIT, you can analyze how profitable your investments in a company will be.

- EBIT helps assess profit before it’s impacted by interest rates and tax burdens, i.e., to lay the foundation for further comparison of different issuers (companies with different capital structures and tax regimes).

- EBIT is easy to calculate and easy to understand. We can say that this indicator is one of the first numbers to help users assess a company basically.

- The use of EBIT isn’t limited to its calculation. This metric is also used as input data when calculating other financial ratios.

Limitations

- EBIT includes amortization. EBIT of a company with a significant amount of fixed assets will be less than the EBIT of a company where their amount is low after deductions.

- A company with a large portion of debt financing has significant interest costs. Since EBIT doesn’t take them into account, it can distract attention from significant debts. If a company is increasing its debt burden due to weak sales or lack of cash flow, then it’s critical. Besides, keep in mind that raising rates will affect the company’s interest costs (they’ll be increasing).

- EBIT Margin

- In practice, you can come across EBIT Margin (also known as Operating Margin). Take a look at the formula and detailed calculations for Netflix and Comcast below. Learn more about the ratio in Lesson 14.

⇐ Key to making money with shares. Lesson 23. ICR Key to making money with shares. How to pick stocks ⇒

Useful articles:

Login in Personal Account