In this article, we are going to dissect a topic of clearing, its essence, purpose, and types, as well as explain why traders must know about it. To put it simply, clearing is a procedure of processing of non-cash transactions based on mutually offset operations. In essence, the clearing is done in order to match all buy and sell orders in the market.

1. What is clearing and what are its types

2. Who is in charge of clearing activities

3. What is clearing for

4. What should traders know about clearing

Clearing can take place not just between large players (e.g. countries), but also private traders and brokerage companies.

Depending on who or what is involved in trades, several types of clearing operations were singled out. These are:

As far as the interbank clearing goes, the settlements are done between banks. In the case of the currency clearing, settlements are made internationally between countries engaged in trade.

Commodity clearing is a type of settlement carried out between organizations that provide services, sell goods or perform some type of work. And finally, as its name suggests, the exchange clearing implies settlements done on exchanges.

In the stock exchanges, the organization that acts as an intermediary and performs clearing operations is called the clearing house.

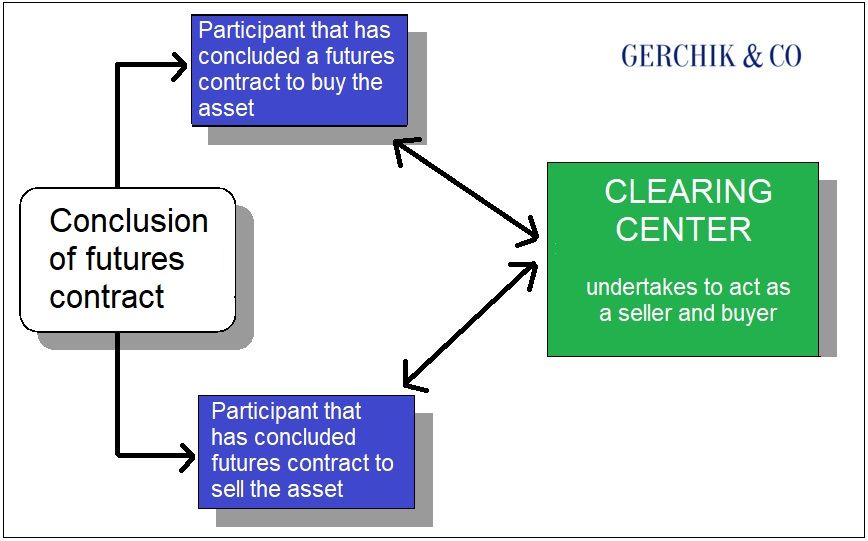

Clearing can also be done by both an individual and an organization that concluded an agreement with the exchange for conduction of such transactions. Clearing centers or settlement organizations can be entrusted with clearing transactions. The picture below illustrates how this is done in the futures market.

E.g. In the FORTS market, clearing operations are tackled by the RTS Clearing Center. In options and futures transactions, it basically acts as a guarantor for commitments undertaken by those involved in the trading process.

Settling a transaction between counterparties takes time. That being said, the trading speed in the financial markets exceeds the time needed to process the trades in the stock exchange. The clearing process includes reporting and monitoring of the transaction, calculation of net income, tax processing and order reconciliation.

Clearing is aimed at minimizing the number of funds transfers and cash payments. It also allows keeping the costs of such cash transactions (storage, transportation) down, while speeding up the exchange of money using wire transfers.

So, by answering the question “What is clearing and what is it for?”, we can sum up that the purpose of this procedure is to reconcile all of the figures, check the documents relating to futures contracts, as well as the customers’ accounts and their debts.

If we are talking about private traders, clearing means a change in the trading account balance as a result of trades made.

Those who trade in the stock market are familiar with the clearing sessions during which the recalculation of funds takes place. Let’s see how it is done.

So, clearing is essentially a recalculation that takes place in the stock exchange at specific time intervals. E.g. In the FORTS market, where futures and options are traded, there are interim and final clearance during the trading session.

Interim clearance takes place at 2:00 p.m. and lasts for 3 minutes. The final clearance is 15-minute-long and is done at the close of the trading session.

We have already figured out what clearing is. But what changes happen in the trader’s account during this time? Let’s assume that a trade to buy the futures contract was opened at the beginning of the trading session. Since then, the price has gone up and the trader earned a profit; however, this trade has not been recorded in his or her account yet.

Even if the deal is not closed before the commencement of the clearing session, trades stop from 2:00 p.m. to 2:03 p.m., while the amount of profit is credited to the trader's account. If the deal turns out to be unprofitable at the time of clearing, the difference between the position opening price and the price at the time of clearing will be debited from the account.

During the clearing sessions, the amount in the client’s trading account changes, even if the deal has not been closed yet. Due to this, in order to know how much money will be required for maintaining open positions, and how much can be spent on opening new trades, the trader needs to pay close attention to the amount of money that is left after the recalculation.

Protect yourself against the trading risks

using Risk Manager brought to you by Gerchik & Co!

Learn more about the service