You have most likely heard that forex exchange, also known as forex or FX, is open 24/7, five days a week. Newbie traders believe that with a schedule like that you can easily trade and make a profit whenever you like but it’s not entirely true. In order to use your time efficiently, you need to know when to enter the market.

What is the best time and day of the week to trade? In the following article, we are going to answer this question. But first, let’s start with the basic information.

Contents:

1. What does today’s forex trading look like

2. Trading hours of the foreign exchange market

3. Forex trading: Peak activity in terms of time, days, and seasons

4. What is the worst time to make trades

5. 10 facts about forex you should know if you wish to make money in it

6. How to start making money trading forex: Tips from experienced traders

7. By completing several simple steps, you’ll be able to trade and make money reasonably

8. The backbone of a successful start is a trustworthy broker

9. Analyzing the website of a prospect broker: Things to pay attention to

10. Profitable forex trading with Gerchik & Co

11. 5 reasons to start making money with Gerchik & Co

12. Basic terms and definitions used by forex market players

13. What makes the forex market so appealing

14. Analytical methods used by veteran traders

15. If you wish to make money, keep your excitement under control and act wisely

16. Here’s what you need to know about forex

17. Financial instruments in the foreign currency market

18. Winner’s strategy or how not to lose all your money in one go

Forex is an international currency exchange. In a nutshell, all transactions that involve foreign currency are made in forex. All of us have bought or sold foreign currency in the exchange offices at least once in our lives which basically means that we were engaged in the currency transaction. Obviously, actual forex trading involves large banks and international corporations that regularly buy or sell foreign currency as a part of their business activities.

Nowadays, all kinds of investors, brokers, and traders are able to engage in foreign exchange trading. You can purchase and sell any currency you like in the forex market.

A specific purchase price — ASK — and the sale price known as BID are established in terms of each currency. The difference between the two determines the value of the current pair. Pip i.e., percentage in point is used to measure the smallest change in the exchange rate of the currency pairs. Depending on whether the value of the currency goes up or down, and what type of deal traders make, they either make a profit or incur a loss.

This is the simplest explanation of the nature of forex trading. People who decide to try their hand at it must keep in mind that forex trading is not a gambling game or a lottery. You will have to complete relevant training, learn the ropes of foreign exchange trading and the basics of risk management.

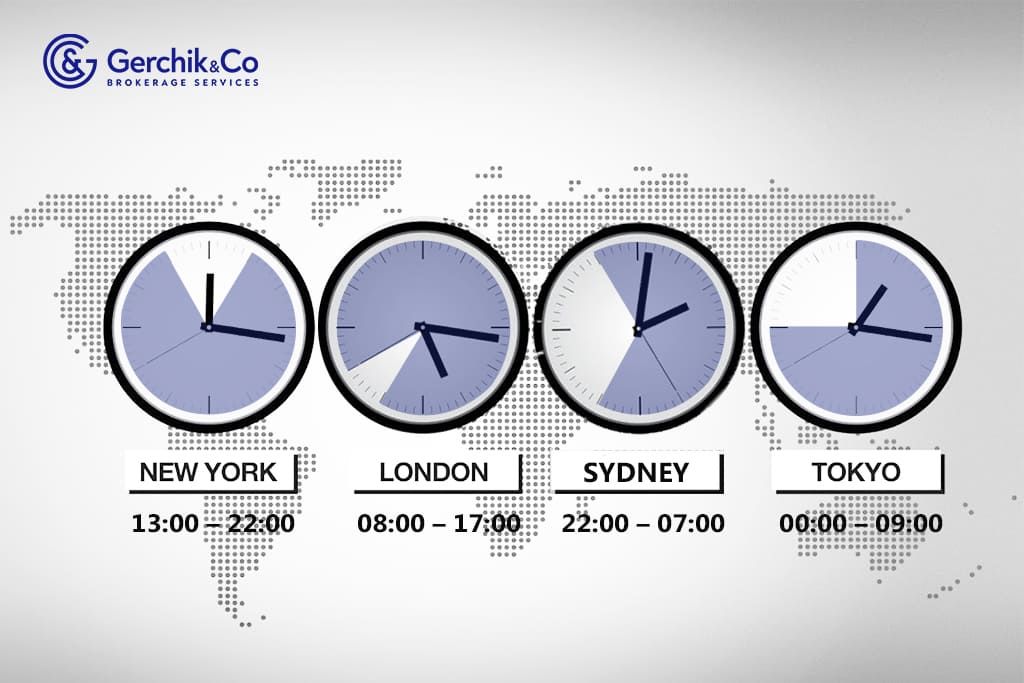

Since forex is international exchange, its operation is arranged in such a way as to suit different world’s time zones. There is no way to have a universal time for everybody as the market players are scattered around the globe. This explains why forex is open 24 hours a day and has four separate sessions, the opening and closing times of which are based on Greenwich Mean Time.

.jpg)

So, what do we have? Forex does work around the clock. With that said, the market activity is not the same. Since we can only profit from a drop or increase in the price of the traded asset, we need to pick the right time for it. Thing is, it varies from session to session. Plus, the activity of a particular currency depends on the time and session itself. Let's take a closer look at the specifics of each trading session in the table below.

There is a time period when two sessions are open at the same time and overlap:

These are peak hours of trading activity. The most liquid overlap sessions are London and New York. This is when the most trades are made making it an excellent time for active market participants.

Based on the analysis of the volatility of different currency pairs, Tuesday and Wednesdays are considered to be the best days of the week to make trades.

In terms of the seasons of the year, we should first mention December. Before the holiday season starts, the volatility is quite high. However, after the 20th of December and until mid-January, there is a period of inactivity in the market. Once the holidays are over, things go back to normal. Forex remains very active until the end of summer, or rather, until July-August when loads of people go on vacation with their families. In September, the trading intensifies again with peak activity lasting from mid-October to mid-December.

In addition to the above, there are also time periods when making profits in forex is difficult if not impossible, or is associated with major risks. This is why, if you are a beginner, you should consider refraining from trades during that specific time:

If you wish to make an income trading forex, you need to be aware of the 10 key facts about the world’s biggest foreign currency market:

1. You need brokers to make trades.

2. By getting registered on the broker’s platform, you get access to the assets traded in the financial market.

3. You can open an account in any tradable currency.

4. The foreign currency market is open round-the-clock, 5 days a week.

5. The trades involve currencies each of which has three key capital letters, e.g., EUR.

6. There are seven most popular currency pairs where one is the U.S. dollar, while the other one is typically the currency of the world’s most developed countries.

7. The whole point of trades is to buy one currency at the cheapest price and sell at the highest.

8. The duration of the trades can be from several seconds—which is what the pipsing strategy is all about—to a longer period of time, e.g. carry trade.

9. The traders can use borrowed capital known as leverage which is provided by the brokerage company.

10. The deals are made remotely using special apps you can install on your computer or any other device.

If you have your heart set on forex trading, you have to seriously consider learning everything there is to learn about currencies and risks, in particular prediction of the rise or drop in the exchange rate. Many traders learned to trade profitably the hard way, while those who were particularly reckless managed to not only lose the invested money but also plunge themselves into huge debts.

For starters, you need to understand that this is a serious matter and not just some easy money, as you may be promised by shady brokers in their ads. The situation in the currency market depends on a variety of factors. These are the economic and political environment in the country, the behavior of large companies, banks, and currency reserves. Even rumors can trigger fluctuation of a particular currency.

In order not to find yourself among those who have lost more than they’ve made, learn the basics first:

Aside from that, be sure to read the articles covering the ins and out of the currency and stock markets, and check out videos with first-hand stories shared by experienced traders.

Finally, explore different options offered by brokers. In our day and age, there are loads of them to choose from but it’s important to be extra careful when picking one that won’t vanish with your money after a while.

You can stumble upon many online offers promising huge—and quick—profits. However, a lot of them are nothing but a pure scam that has nothing to do with actual trading and real profits. Thing is, if you wish to make good money, you have to approach trading with caution and act accordingly. Trading currencies in forex is a great option for those looking for ways to make steady income remotely. If you have decided to try your hand at.

1. Choose the right broker. This is a serious decision your entire trading future virtually depends on. This is why we have focused on the aspects you should pay close attention to when picking a potential brokerage company.

2. Install a demo version of the trading software, put your skills and theoretical knowledge to the test using a demo account. Give your trading strategies a whirl and try to predict further movement in the exchange rate using analysis of various technical indicators. With the demo account, you don't have to be afraid to take risks, while being able to explore different options to see what works.

3. Open a live account with a reliable broker.

Don’t expect success to come overnight. Remember - the road is made by walking!

Open an account with a reliable broker now

Those who are serious about making money in the foreign exchange market need to carefully pick a dealing center. Keep in mind that where there’s money, there are always scammers. So, before choosing a particular brokerage company, make sure to do a thorough background check:

1. Duration of business operation. The dealing center should be about 10 years old. More often than not, the companies who have operated no more than 1 or 2 years shut down without returning the money to their customers, obviously.

2. The volume of trade turnover pointing to the size of the dealing center. The larger the brokerage company, the more reliable it is. You can find this information on the broker's website. Typically, the number of traders is shown on the home page.

3. Adequacy of perks and freebies. If you are promised to have your trading deposit tripled within a week, this is far from the truth. Gerchik & Co does not promise you massive profits instantly. Only strong determination, willingness to learn, patience, and persistence can yield positive results.

4. Regulators. A trustworthy dealing center discloses the companies that control the broker on its website. Should any dispute arise, you can appeal to the regulator to have it resolved.

5. Available license. It can be a license issued in Ukraine or any other country, but there has to be one. If the broker does not have a license authorizing it to carry out this type of activity or the brokerage company’s representatives promise to obtain it shortly, it’s safe to say that you are dealing with scammers.

Having a solid broker is essential. Typically, aside from issuing loans, the DC professionals hold workshops and webinars for traders and provide advice that can help you earn consistent income.

Everyone who wishes to earn income through forex trading and avoid sending the money down the drain has to stay disciplined and refrain from decisions driven by emotions. Aside from the above recommendations on how to choose the right brokerage company, you should pay attention to the following aspects:

PLEASE NOTE!

By taking small yet consistent steps, you can achieve more than by risking it all. Trust only proven dealing centers with sound reputation.

These and many other factors that include automated deposit protection win traders’ trust.

If you still haven’t decided on the broker, here are five reasons why it would be a good idea to start officially trading forex with Gerchik & Co:

The company’s mission is to provide traders with every opportunity to make a profit and make their trading journey as smooth as possible. The entire team puts its best foot forward to do so. Your success matters to the company as much as its own reputation.

Just like any other activity, forex trading has its own words and expressions used to describe specific processes, actions, and participants. In the table below, we listed the key terms newbie traders should familiarize themselves with.

| Term | Definition |

| Trader |

An individual or legal entity that is trading in the stock exchange on its own behalf. |

| Broker |

A legal entity that is acting in the best interests of the trader. This is an intermediary company acting on behalf of traders, servicing clients in terms of quotes, providing relevant training for those who are only starting to trade. |

| Currency Dealing |

Currency exchange transaction. |

| Pip |

This is a unit of measurement for currency movement and has a value of 0.0001. The currency price in forex has four decimal places after the decimal point. Thus, the change in the last digit by one pip means that the price of the currency has dropped or increased by 0.0001. |

| Lot |

This is the standard number of units, an equivalent of 100,000 units of the base currency you can buy or sell in forex. |

| Ask |

Purchasing price for the given currency. |

| Bid |

Selling price for the given currency. |

| Spread |

The difference between the bidding and the asking price of the currency. |

| Leverage |

The relationship of the trader's own funds to a loan provided by the broker. |

This is not a full list of expressions used by forex players. To learn the terminology, you need to complete relevant training.

Many people strive to learn how to make a lot of money while putting in minimum effort. Forex trading attracts a huge number of newbies yet not all of them stay. What makes this type of work so attractive? Obviously, every person would name his, her, or their own reasons but the key ones are:

1. The ability to work from anywhere in the world as long as you have an Internet connection.

2. Possibility to make deals quickly typically by pressing one or two keys on a laptop or smartphone.

3. Ability to use mathematical knowledge to make relevant forecasts.

4. A large number of participants practically eliminates the possibility of conspiracy.

5. The foreign exchange market is highly sensitive to changes in the economic and political environment in different countries. Having this information allows you to make on-the-spot decisions and buy or sell a particular currency.

6. The exchange is open 24 hours a day, five days a week. If you are just starting your trading journey, this is very convenient since you can trade whenever you are not busy with your main job.

7. Unlike the stock market, where you can only make money if you buy at a lower price and sell at a higher price, forex offers you a chance to profit from both the increase and drop of the currency price.

It obviously comes without saying that all of this is possible if you act wisely using technical and fundamental analysis.

Do all novice traders wish to learn how to start making money? When will money begin to flow? We recommend that you remain patient and take small yet consistent steps by relying on the knowledge you can acquire with the assistance of your broker.

Needless to say, you need to choose and put your trust in a credible brokerage company. Pro traders always use two methods to predict the behavior of a particular currency for a given time period.

| Method | Details |

| Fundamental analysis | This method considers a variety of factors occurring in a country that is a holder and issuer of the currency you are interested in. These include changes in the rates of inflation, unemployment, growth or decline in GDP, acts of a military nature, elections, etc. A change in these factors may have an impact on the depreciation or strengthening of the currency traded in forex. |

| Technical analysis | This approach implies the use of mathematical models, charts, and patterns allowing to make a forecast for future quote movements based on specific data. |

By owning these financial instruments, traders can earn profits through the purchase or sale of currency assets in the international exchange.

Psychology is one of the key aspects of forex. Human nature dictates that when you have to make a decision quickly, emotions come to the fore. This is what many traders struggle with and often lose trading deposits. The fear of failure is what pushes us to make mistakes. For instance, not everybody can close a position when there is every reason to do that. The urge to bounce back can make you act carelessly which in turn leads to real trouble. By being aware of this, you can protect yourself from mistakes.

More often than not, prejudice and overconfidence take the lead. Psychologists recommend that traders do not let emotions get the upper hand and stick to the trading strategy and follow the plan.

When answering the question of how to start making money in forex, successful traders and psychologists suggest learning to keep your emotions under control. Being in the right headspace and having a relevant mental capacity are essential for making informed decisions. Do not ignore the red flags telling you that your excitement is taking over you. Better move slowly rather than risking everything and losing all you’ve got.

This article is intended for everyone who is interested in making money through forex trading. Armed with this information, you can weigh all the factors and make a smart decision. Here are a few more facts about the foreign exchange market which will hopefully not scare you off but will rather help you take trading more seriously.

1. More than 90% of traders who are making their first steps in it lose their trading deposit. As a matter of fact, this unfortunate scenario is not uncommon even for those who had successfully traded in a demo account before. Why does this happen? The culprit behind it is the psychological aspect and the fear you experience when starting to trade with real money. That’s why psychological preparation is so vital.

2. Only 7% of traders continue to trade after facing the first failure with a live trading account.

3. The majority of traders are based in the UK, the United States, and Germany. Aside from that, the most in-demand currency remains to be the U.S. dollar.

4. Most losses are incurred when traders are in a state of emotional agitation. If you wish to make real profits, build your self-control and endurance.

While brokers can help you fill the theoretical knowledge gap, provide relevant educational books, videos and content, the psychological aspect depends solely on you.

Check this video to learn more about forex

In order to manage foreign exchange flows efficiently, market players use a number of special instruments.

| Instrument | This is how it works |

| FX spot | This is a type of transaction made between buyer and seller of the currency “at the spot rate.” The payment is made within 48 hours which allows using the received profit right away or withdrawing it. |

| FX forward contract | This type of FX transaction implies the exchange of a specific currency for another at a fixed rate on a specific date. The payment deadline can be from 3 days to 5 years. |

| Futures | Under the terms of the futures contract, the supplier is obliged to deliver the agreed amount of the base currency on a specific date at the price that was valid at the time when the transaction was made. |

| Option | This type of transaction gives the holder the right but not an obligation to buy or sell an asset at a fixed cost within a specific time period. Depending on whether it generates profit or not, the holder may or may not do it. |

| Forex swap | This is a transaction between two parties that agree to simultaneously purchase and sell identical amounts of currency at a fixed price. |

To be able to trade in the foreign exchange market, the traders will have to explore many other trading instruments and tools. But first, memorize the key ones which will come in handy when watching educational videos and reading articles. That way you’ll have a better understanding of the discussed topic.

So, you have made up your mind and wish to proceed with your education or actual trading. To help you along the way, we have compiled some tips below. Stick to these simple rules to protect yourself against hasty decisions and deposit loss:

1. If you are a newbie, don’t use high leverage right away. Better practice with a small amount of money first. It's great if you make the right guess and earn some profit. However, beginner’s luck is not always the case. More often than not, novice traders fall victim to their own ambitions and over-confidence. Be sure to start small.

2. Limit the amount you have in the trading account opened with a forex broker. Should your prediction turn out to be inaccurate, the broker will forcibly close the trade so that you don’t go into the red. How much you can potentially lose in case of prognosis miscalculation depends on your deposit amount.

3. Use automatic exit from the position i.e., stop loss. There is a wide range of forex software allowing you to set a certain threshold for trades. Once it is reached, you get kicked out of the market. This is done to prevent you from losing the entire deposit in one go.

4. Reasoning, critical thinking, and the ability to make informed decisions based on data analysis lie at the heart of any human activity. Don’t treat stock exchange trading as gambling. Just like any other line of work, it requires specific knowledge, logical thinking, and the ability to keep your emotions under control. Armed with these skills, you have a chance to succeed and make your first million.