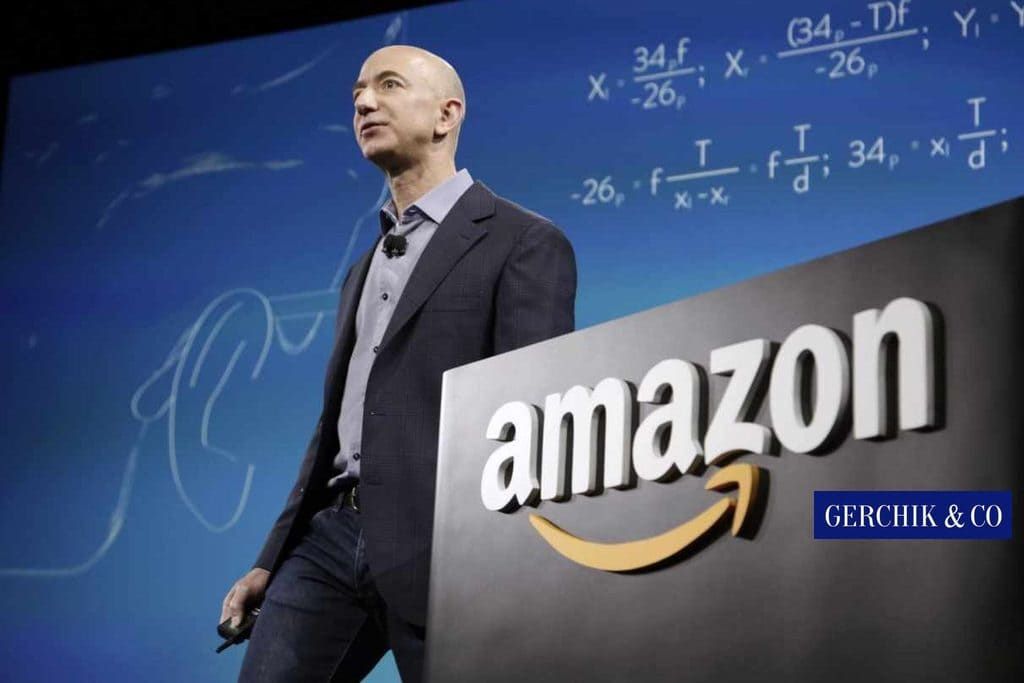

A room that looks like a students’ dormitory back in Soviet times, white walls and a wall poster with the company name drawn with a highlighter pan. A table, one computer, a telephone and a man sitting with his back turned to the window. This is where the story of Amazon and Bezos The Billionaire, who started his business with a website named after the Amazon River, begins. In 24 years, his company’s stock market value would reach over $900 billion.

Amazon sells everything from books to CDs, video products and MP3s, to software and video games, electronics, clothes, furniture, food and toys - you name it! The time was right and it filled the demand in the market through an online intermediary.

In 1997, the company got listed on the Nasdaq exchange. Since 2006, Amazon was able to pull off the takeovers of Shopbop, Quidsi (for $545 million), Kiva Systems (Massachusetts-based company that manufactures mobile robotic fulfilment systems), and Whole Foods Market (for $14 billion).

Amazon Studios, television and film producer and distributor that is a subsidiary of Amazon, emerged back in 2013. Without going deep into fundamental figures, I believe the acquisition amounts and the scale of the business itself are the best evidence of the company's ginormous cash flows.

Amazon is indeed an e-commerce giant with the S&P 500 index being 2.88. As far as the size of its Schertz-based fulfillment center goes, it occupies the 12th place in the list of the world’s largest buildings.

A curious fact that confirms that advertising is what drives the progress is that the biggest portion of Amazon’s expenses is linked to advertising. And this is where the company leaves all of its competitors far behind. It also explains the jaw-dropping figure of 30,000,000 sales made a day. And no, you have not made a mistake when counting zeros - it is, in fact, 30 million. Basically, the annual income of AMZN exceeds the GDP of many countries.

Unfortunately, the company does not pay dividends. So, the stockholders have to simply come to terms with the fact that Amazon thinks it knows best how to use its cash. All the investors can really do here is wait for the difference between the buy and sell price.

In this type of situation, the risks of expensive prices, unfortunate reports and a drop in value are naturally pretty high, even if you are a lucky holder of this company’s stocks. It suffices to recall the APPL correction of more than -38% back in 2018. Profitability at the level of 6.20% by ROA, 22.50% by ROE, and 11.90% by ROI. It is fairly good overall. In contrast, however, the similar figures of APPLE are twice as high, whereas the Amazon stocks are significantly more overestimated against the reports. But we’ll discuss that later.

During the period from 2014 until late 2018, the company's revenue skyrocketed from $88.99 billion to $232.89 billion, while net profit from losses of $241 million reached up to $10 billion per annum.

The starling growth rates with an average of +225% per year have created the expectation that the issuer would continue maintaining such rates, and the price includes all subsequent take-offs of the company. That said, in order to make a better assessment, we should take a look at the dynamics of the recent reports and analyze whether the company is moving at the same pace.

The latest quarterly reports demonstrate that average EPS remained at about $6 per share and even reached $7 in the April report. However, subsequent reports came as a sobering slap, making us realize that each business has its own ups and downs, and at least a temporary maximum. In July, EPS dropped to $5.22. In October, this figure hit $4.23, and is expected to be at $4.05 in January.

So, what exactly are the latest reports telling us? They are making us aware that with an average EPS being $6, expectation per annum was $24 per share, while the average of $4 per quarter was already $16 per annum. In other words, with the current price being 1870 per share, P/E is shifting from 77 to 116. This means that in order to remain consistent with the price reports, the company has to generate $124 EPS per annum, or $31 per quarter.

But virtually, AMZN is moving further away from these figures, and another frustrating report or market correction may overestimate stocks exponentially, even if these are the stocks of such a giant corporation.

Speaking of which, only 0.95% is concentrated at short positions. Just compare the figures with TSLA’s 27% at short positions when the price was trading at 200. So, no movement will be generated due to the closure of positions by the short-sellers: the company either publishes great reports that confirm the intended profit growth dynamics towards $31 per quarter or will be doomed to face a significant correction.

From a technical standpoint, the instrument is within a wide range of 1351–2032. If we start from current reports adjusted for more realistic expectations and reach $7 per quarter, going long from a round price of 1,000 will still be speculation, given how the stock went up due to artificial demand resulting from irrational expectations.

The current local one is the exit from 1687–1844.5 range, where 1844.5 is at a key support. For the time being, the new heights in the market are holding the stock, but the bad news for the issuer is that the new highs are not conquered anymore.

I personally enjoy their services and used them more than once. I also like their solutions and the quality of e-books with no text glare. And, of course, the accuracy which is one of the best (if not the best) on the market. However, I can’t say the same about the reasonableness of stock prices.

Author: Victor Makeev