The last trading week of 2022 is ending for the EUR/USD pair with continued consolidation in a narrow range. Impulse exit beyond its boundaries and the overall direction of the pair’s further movement will depend on the drivers that will emerge in the market after the New Year’s break.

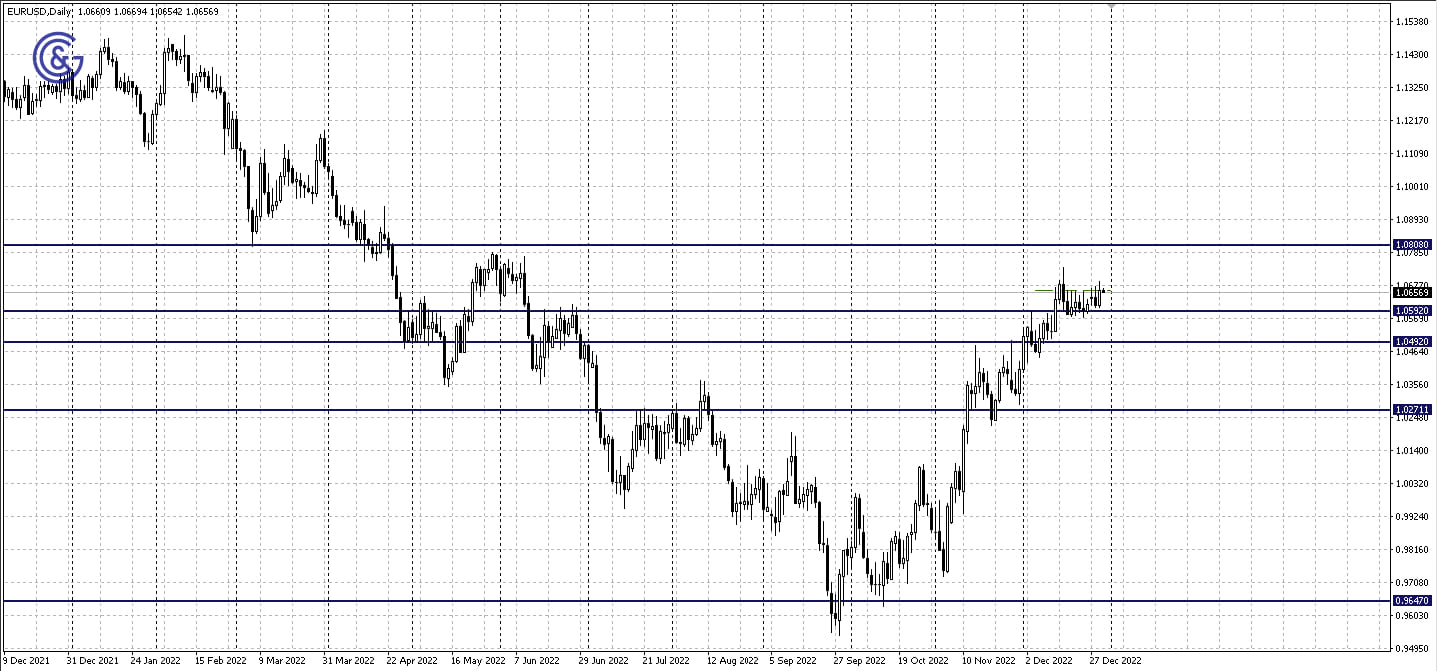

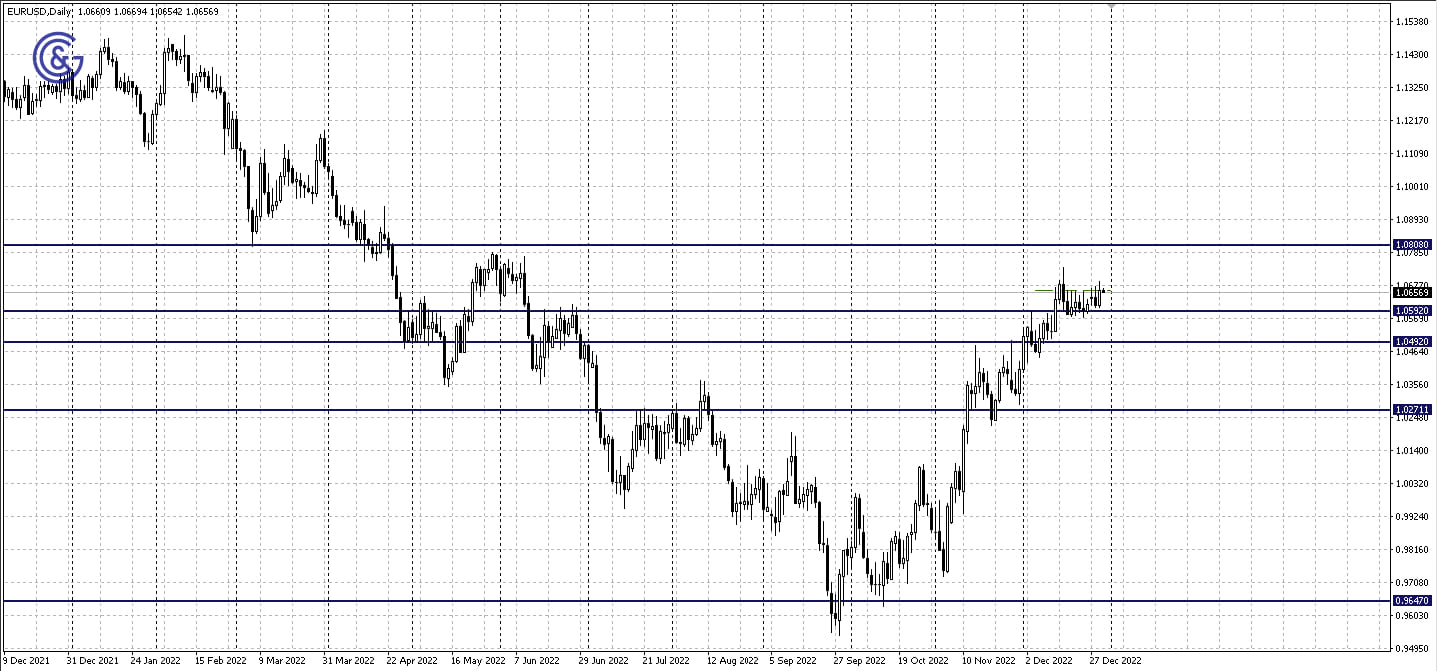

The technical picture on the EUR/USD daily chart has remained the same for two weeks. The price keeps consolidating above the 1.0592 support. Meanwhile, the attempts to overcome the last week’s highs end up becoming false breakouts. When exiting the consolidation corridor upwards, the 1.0808 resistance will be the nearest growth target. If the support gets broken out, the quotes may move to 1.0492.

Today’s news background will be scarce, with market liquidity remaining low.

The United States Chicago Purchasing Managers' Index for the month of December will be released at 2:45 PM GMT. The figures are expected to increase from 37.2 to 40.0. That being said, you should factor in the likelihood of a volatile reaction to the news if there is a major discrepancy between the actual figures and projected ones against the backdrop of the thin market.

On the 4H chart, the EUR/USD pair moving beyond the 1.0661 resistance does not look convincing. If the breakout remains false, the price may move to the 1.0592 support.

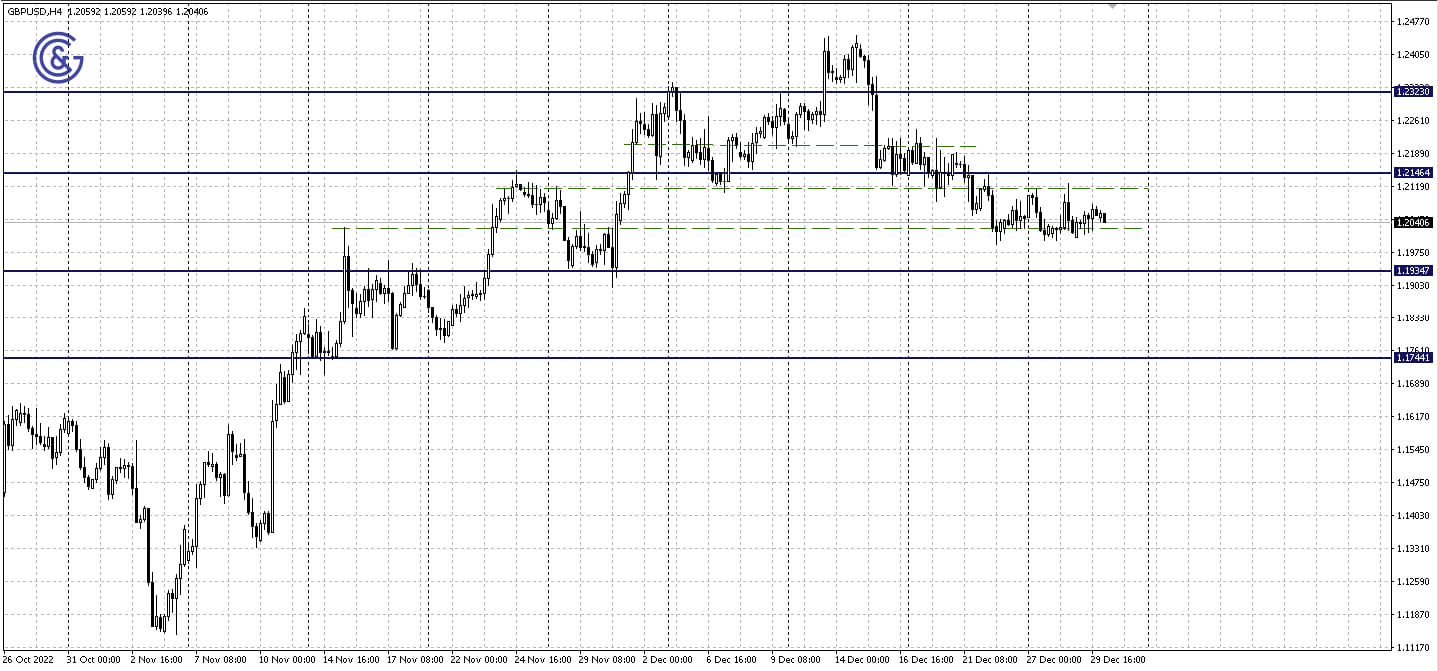

The GBP/USD continues to consolidate as it is waiting for liquidity to return back to the market and the new fundamental drivers to show up so that it could exit the horizontal trend.

On the GBP/USD daily chart, the price remains in the middle of the 1.1934 - 1.2146 sideways range, while having sufficient movement range to any of its boundaries. Given the fact that the formation of the bearish flag pattern was completed last week, there is a likelihood of a drop in quotes.

The release of the United States Chicago Purchasing Managers' Index for the month of December at 2:45 PM GMT may have a local impact on the dynamics of the U.S. dollar in the pair if it does not match the anticipated figures. An increase from 37.2 to 40.0 is expected. That being said, it probably won’t change the technical picture all that much.

On the 4H chart, the GBP/USD pair remains within a narrow sideways range of 1.2028 - 1.2112 marked with green dotted lines. The exit from it is likely to happen downward.

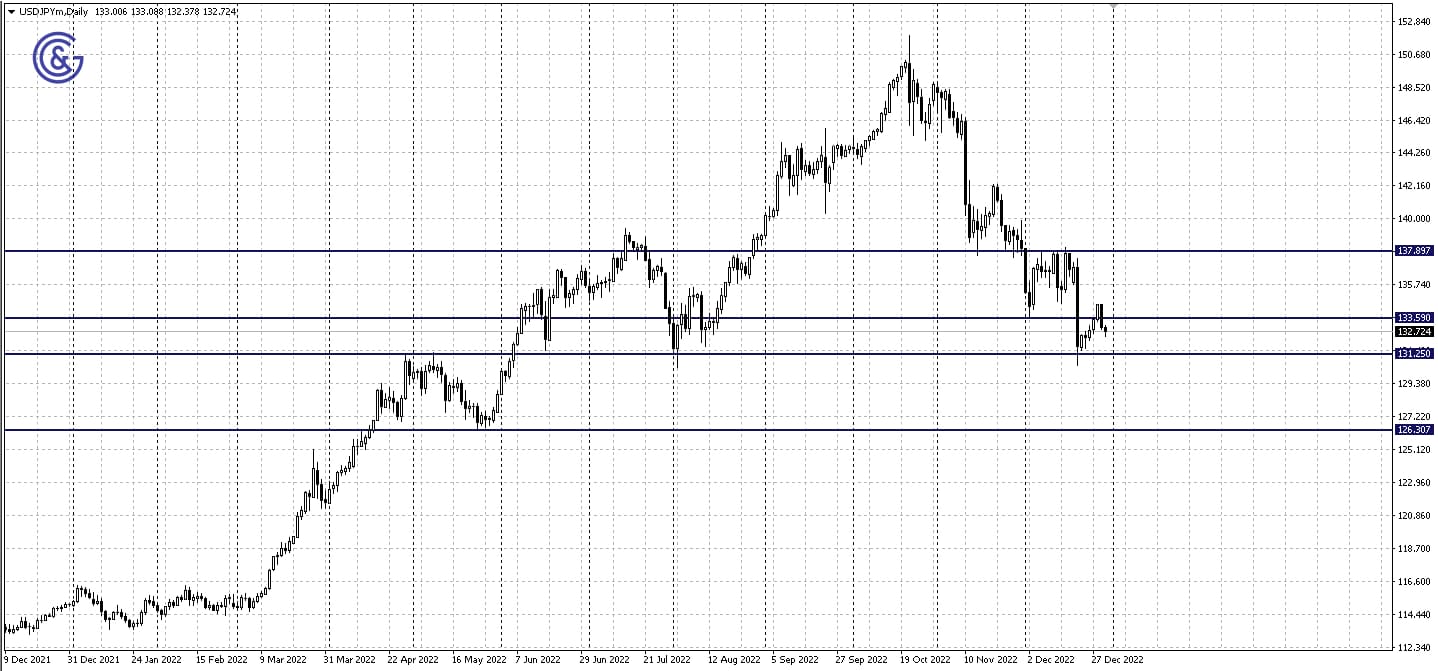

As the market players have followed the Bank of Japan’s decisions closely after the yield control policy change, the Japanese yen has been the main focus this week. Although investors believe that this may imply that the central bank is shifting away from the super-soft monetary policy, the Bank of Japan is still doing its best to convince them otherwise.

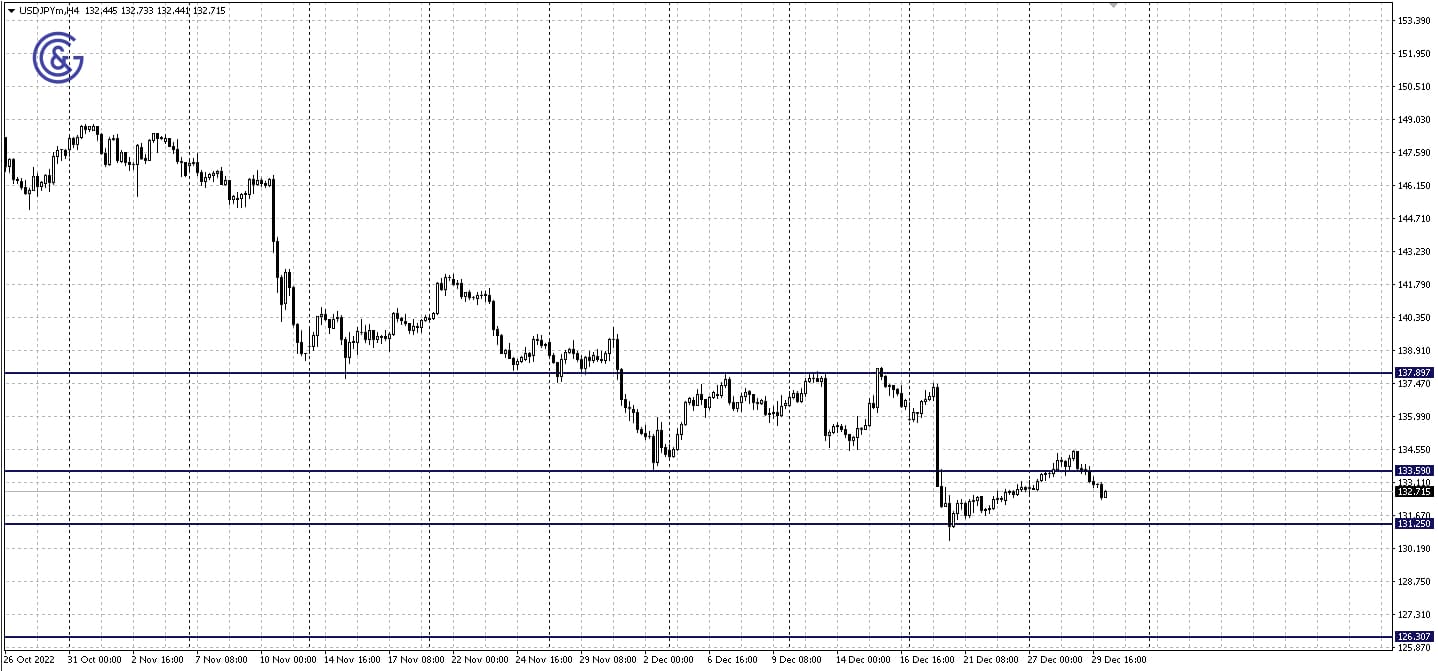

As far as the technical picture goes, there have been mostly no major changes since last week. The price is staying within the 131.25 - 133.59 side range, which it failed to exit from upwards yesterday. At the same time, there is enough room for the price to move towards support, while the breakout is not ruled out in the medium term.

United States Chicago Purchasing Managers' Index for the month of December will be released at 2:45 PM GMT which may locally affect the dollar's volatility if the actual figures are higher or lower than expected. An increase from 37.2 to 40.0 is anticipated.

On the 4H chart, the USD/JPY pair is moving down and may grow weaker towards the support level of the 31.25 - 133.59 corridor.